ASTM E1074-93(1998)e1

(Practice)Standard Practice for Measuring Net Benefits for Investments in Buildings and Building Systems

Standard Practice for Measuring Net Benefits for Investments in Buildings and Building Systems

SCOPE

1.1 This practice provides a recommended procedure for calculating and interpreting the NB method in the evaluation of building designs and systems.

General Information

Relations

Standards Content (Sample)

NOTICE: This standard has either been superseded and replaced by a new version or withdrawn.

Contact ASTM International (www.astm.org) for the latest information

An American National Standard

e1

Designation: E 1074 – 93 (Reapproved 1998)

Standard Practice for

Measuring Net Benefits for Investments in Buildings and

Building Systems

This standard is issued under the fixed designation E 1074; the number immediately following the designation indicates the year of

original adoption or, in the case of revision, the year of last revision. A number in parentheses indicates the year of last reapproval. A

superscript epsilon (e) indicates an editorial change since the last revision or reapproval.

e NOTE—Footnote 5 of this standard was editorially corrected in September 1998.

INTRODUCTION

The net benefits (NB) method is part of a family of economic evaluation methods that provide

measures of economic performance of an investment over some period of time. Included in this family

of evaluation methods are life-cycle cost analysis, benefit-to-cost and savings-to-investment ratios,

internal rates of return, and payback analysis.

The NB method, sometimes called the net present value method, calculates the difference between

discounted benefits (or savings) and discounted costs as a measure of the cost effectiveness of a

project. The NB method is used to decide if a project is cost effective (net benefits greater than zero)

or which size or design competing for a given purpose is most cost effective (the one with the greatest

net benefits).

1. Scope Computer Program and User’s Guide to Building Mainte-

nance, Repair, and Replacement Database for Life-Cycle

1.1 This practice provides a recommended procedure for

Cost Analysis,

calculating and interpreting the NB method in the evaluation of

Adjunct to Practices E 917, E 964, E 1057, E 1074, and

building designs and systems.

E 1121

2. Referenced Documents

3. Terminology

2.1 ASTM Standards:

3.1 Definitions—For definitions of terms used in this

E 833 Terminology of Building Economics

practice, refer to Terminology E 833.

E 917 Practice for Measuring Life-Cycle Costs of Buildings

and Building Systems

4. Summary of Practice

E 964 Practice for Measuring Benefit-to-Cost and Savings-

2 4.1 This practice is organized as follows:

to-Investment Ratios for Buildings and Building Systems

4.1.1 Section 2, Referenced Documents—Lists ASTM stan-

E 1057 Practice for Measuring Internal Rate of Return and

dards referenced in this practice.

Adjusted Internal Rate of Return for Investments in Build-

4.1.2 Section 3, Definitions—Addresses definitions of terms

ings and Building Systems

used in this practice.

E 1121 Practice for Measuring Payback for Investments in

4.1.3 Section 4, Summary of Practice—Outlines the con-

Buildings and Building Systems

tents of the practice.

E 1185 Guide for Selecting Economic Methods for Evalu-

2 4.1.4 Section 5, Significance and Use—Explains the appli-

ating Investments in Buildings and Building Systems

cation of the practice and how and when it should be used.

2.2 ASTM Adjuncts:

4.1.5 Section 6, Procedures—Summarizes the steps in mak-

Discount Factor Tables,

3 ing NB analysis.

Adjunct to Practice E 917

4.1.6 Section 7, Compute NB—Describes calculation proce-

dures for NB.

4.1.7 Section 8, Applications—Explains circumstances un-

This practice is under the jurisdiction of ASTM Committee E-6 on Performance

der which the NB method is appropriate.

of Buildings and is the direct responsibility of Subcommittee E06.81 on Building

Economics.

Current edition approved Jan. 15, 1993. Published March 1993. Originally

published as E 1074 – 85. Last previous edition E 1074 – 91.

2 4

Annual Book of ASTM Standards, Vol 04.11. Available from ASTM Headquarters. Order PCN 12-509171-10 for the 3.5 in.

Available from ASTM Headquarters. Order PCN 12-509179-10. disk. Order PCN 12-509172-10 for the 5.25 in. disk.

Copyright © ASTM International, 100 Barr Harbor Drive, PO Box C700, West Conshohocken, PA 19428-2959, United States.

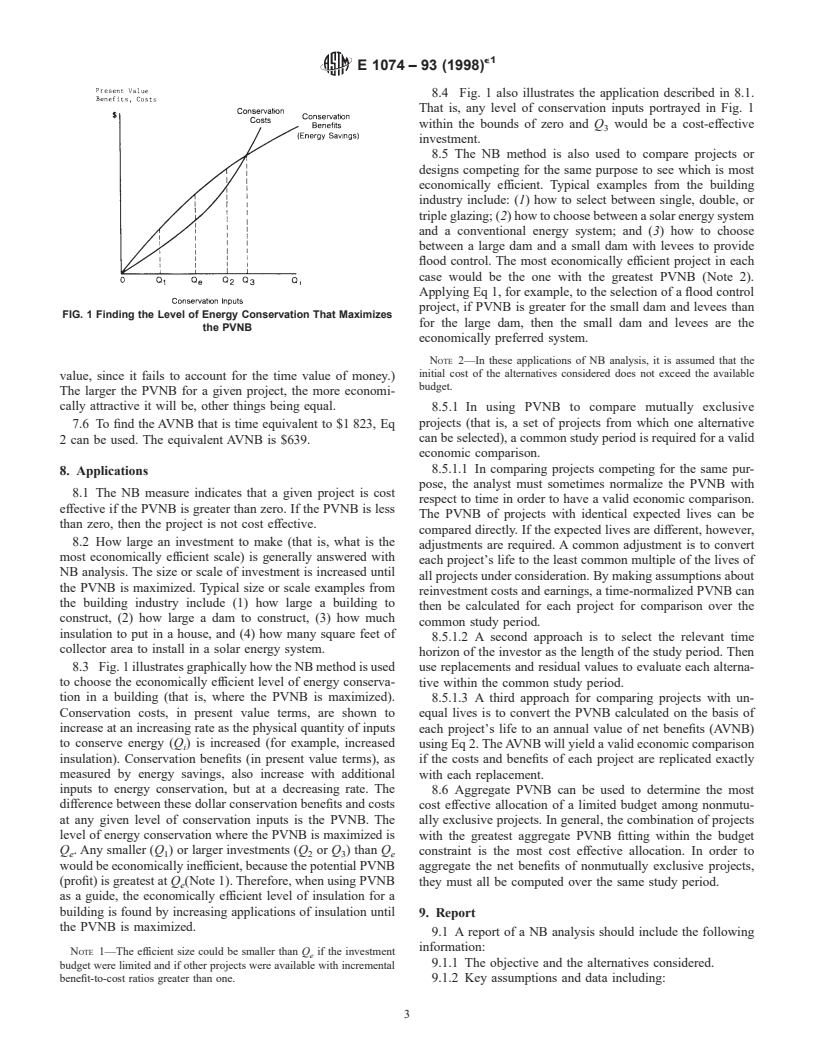

e1

E 1074 – 93 (1998)

TABLE 1 Calculation of Net Benefits

A B

Net Cash Flow SPV Factor

Year, t Benefits, B , dollars Costs, C , dollars PVNB, dollars

t t

B − C , dollars fori=15%

t t

0 0 10 000 −10 000 1.000 −10 000

1 4 000 3 000 +1 000 0.8696 +870

2 11 500 4 500 +7 000 0.7561 +5 293

3 10 000 4 000 +6 000 0.6575 +3 945

4 8 000 5 000 +3 000 0.5718 +1 715

Total 33 500 26 500 +7 000 +1 823

A

To find the PVNB of the net cash flow for each discounting period, the single present value (SPV) discount factor is multiplied times the net cash flow. For an explanation

of discounting factors and how to use them, see Discount Factor Tables, adjunct to Practice E 917.

4.1.8 Section 9, Report—Identifies information that should 7. NB Computation

be included in a report of a NB analysis.

7.1 Computation of net benefits for any given project

requires the estimation, in dollar terms, of differences between

5. Significance and Use

benefits, and differences between costs, for that project relative

5.1 The NB method provides a measure of the economic to a mutually exclusive alternative. The mutually exclusive

performance of an investment, taking into account all relevant

alternative may be a similar design/system of a different scale,

monetary values associated with that investment over the a dissimilar design/system for the same purpose, or the do

investor’s study period. The NB measure can be expressed in

nothing case. Benefits can include (but are not limited to)

either present value or equivalent annual value terms, taking revenue, productivity, functionality, durability, resale value,

into account the time value of money.

and tax advantages. Costs can include (but are not limited to)

5.2 The NB method is used to decide if a given project is initial investment, operation and maintenance (including en-

cost effective and which size or design for a given purpose is ergy consumption), repair and replacements, and tax liabilities.

most cost effective when no budget constraint exists. 7.2 Eq 1 is used to compute the present value of net benefits

5.3 The net benefits method can also be used to determine

(PVNB) for the proposed project relative to its mutually

the most cost effective combination of projects for a limited

exclusive alternative.

budget; that is, the combination of projects having the greatest

N

t

aggregate net benefits and fitting within the budget constraint.

PVNB 5 ~B 2 C !/~1 1 i! (1)

(

t t

t50

6. Procedures

where:

B = dollar value of benefits in period t for the building or

t

6.1 The recommended steps for applying the NB method to

system being evaluated less the counterpart benefits

an investment decision are summarized as follows:

in period t for the mutually exclusive alternative

6.1.1 Make sure that the NB method is the appropriate

against which it is being compared,

economic measure (see Guide E 1185),

C = dollar costs, including investment costs, in period t

t

6.1.2 Identify objectives, alternatives, and constraints,

for the building or system being evaluated, less the

6.1.3 Establish assumptions,

counterpart costs in period t for the mutually exclu-

6.1.4 Compile data (see the adjunct entitled “Computer

sive alternative against which it is being compared,

Program and User’s Guide to Building Maintenance, Repair,

N = number of discounting time periods in the study

and Replacement Database for Life-Cycle Cost Analysis”),

period, and

6.1.5 Convert cash flows to a common time basis (discount-

i = the discount rate per time period.

ing),

5 7.3 Eq 2 can be used to convert the present value of net

6.1.6 Compute NB and compare alternatives, and

benefits to annual value terms, where N is the number of years

6.1.7 Make final decision, based on NB results as well as

in the study period.

consideration of risk and uncertainty, unquantifiable effects,

N N

and funding constraints (if any). AVNB 5 PVNB · [~i~1 1 i! !/~~1 1 i! 2 1! (2)

6.2 Since the steps mentioned in 6.1.1-6.1.4 and in 6.1.7 are

where AVNB = annual value of net benefits.

treated in detail in Practice E 917 and briefly in Practices E 964

7.4 For a given problem and data set, solutions in either

and E 1121, they are not discussed in this practice. In calcu-

present value or annual value terms will be time equivalent

lating NB, these four steps should be followed exa

...

Questions, Comments and Discussion

Ask us and Technical Secretary will try to provide an answer. You can facilitate discussion about the standard in here.