ASTM E2495-06

(Practice)Standard Practice for Asset Utility

Standard Practice for Asset Utility

SCOPE

1.1 This practice establishes a quantitative process for asset utility, an asset priority index (API), to provide managers with a method to prioritize assets based on predefined criteria.

1.2 The API has a wide range of applications including, but not limited to, use as a basis for capital investment strategies, deferred maintenance approaches, security design and analyses, continuity of business/risk analyses, and disposition decisions.

1.3 The API model is designed to be applicable and appropriate for entities holding equipment designated as capital assets.

1.4 In addition to the applicability of moveable and durable assets as defined in this practice, this methodology may in whole or in part be effectively applied to intangible property, real property, and materiel.

This practice offers instructions for performing one or more specific operations. This document cannot replace education or experience and should be used in conjunction with professional judgment. Not all aspects of this practice may be applicable in all circumstances. This ASTM standard is neither intended to represent or replace the standard of care by which the adequacy of a given professional service must be judged, nor should this document be applied without consideration of a projects many unique aspects. The word "Standard" in the title means only that the document has been approved through the ASTM International consensus process.

General Information

Relations

Standards Content (Sample)

NOTICE: This standard has either been superseded and replaced by a new version or withdrawn.

Contact ASTM International (www.astm.org) for the latest information

Designation: E 2495 – 06

Standard Practice for

Asset Utility

This standard is issued under the fixed designation E 2495; the number immediately following the designation indicates the year of

original adoption or, in the case of revision, the year of last revision. A number in parentheses indicates the year of last reapproval. A

superscript epsilon (e) indicates an editorial change since the last revision or reapproval.

INTRODUCTION

Identifying assets that are most critical to a mission or practice is challenging for most business

entities. The ability of a business entity to minimize the gap between its asset portfolio and

ever-changing organizational missions often determines its success or failure in achieving designed

objectives. The goal of this practice is to provide managers with a disciplined, quantitative approach

to an inherently subjective decision-making process: determining which assets are critical to an

entity’s designated mission and are therefore deserving of priority attention or funding.

1. Scope 2. Referenced Documents

1.1 This practice establishes a quantitative process for asset 2.1 ASTM Standards:

utility, an asset priority index (API), to provide managers with E 2135 Terminology for Property and Asset Management

a method to prioritize assets based on predefined criteria. E 2219 Practice for Valuation and Management of Move-

1.2 TheAPI has a wide range of applications including, but able, Durable Property

not limited to, use as a basis for capital investment strategies, E 2220 Practice for Establishing the Full Valuation of the

deferred maintenance approaches, security design and analy- Loss/Overage Population Identified During the Inventory

ses, continuity of business/risk analyses, and disposition deci- of Moveable, Durable Property

sions. E 2221 Practice for Administrative Control of Property

1.3 The API model is designed to be applicable and appro-

3. Terminology

priate for entities holding equipment designated as capital

3.1 Definitions:

assets.

1.4 In addition to the applicability of moveable and durable 3.1.1 analytical hierarchy process (AHP), n—decision-

making model that reduces complex decisions to one on one

assets as defined in this practice, this methodology may in

whole or in part be effectively applied to intangible property, comparisons resulting in the ranking of a list of objectives or

alternatives.

real property, and materiel.

1.5 This practice offers instructions for performing one or 3.1.2 asset priority index (API), n—numerical value as-

signed to an asset reflecting its value to an entity’s mission or

more specific operations. This document cannot replace edu-

cation or experience and should be used in conjunction with other critical assignments as defined by the criteria set forth by

management.

professional judgment. Not all aspects of this practice may be

applicable in all circumstances. This ASTM standard is neither 3.1.3 entity, n—agency, company, organization, or institu-

tion.

intended to represent or replace the standard of care by which

3.1.4 equipment, n—nonexpendable, tangible, moveable

the adequacy of a given professional service must be judged,

nor should this document be applied without consideration of property needed for the performance of a task or useful in

effecting an obligation. (E 2135)

a project’s many unique aspects. The word “Standard” in the

title means only that the document has been approved through

the ASTM International consensus process.

For referenced ASTM standards, visit the ASTM website, www.astm.org, or

contact ASTM Customer Service at service@astm.org. For Annual Book of ASTM

This practice is under the jurisdiction of ASTM Committee E53 on Property Standards volume information, refer to the standard’s Document Summary page on

Management Systems and is the direct responsibility of Subcommittee E53.05 on the ASTM website.

Property Management Maturity. Satty, T.L., Fundamentals of Decision Making and Priority Theory,RWS

Current edition approved July 1, 2006. Published July 2006. Publications, 4922 Ellsworth Ave., Pittsburgh, PA 15213, 1994.

Copyright © ASTM International, 100 Barr Harbor Drive, PO Box C700, West Conshohocken, PA 19428-2959, United States.

E2495–06

3.1.5 equipment management, n—systematic planning and 4.2.6 Step 6: Calculate anAPI based on the criteria weights

control of equipment to optimize its service delivery potential; and scoring guidelines.

the management of associated risks and costs throughout its 4.3 Should the practitioner wish to apply this method to an

lifecycle in support of organizational objectives; the process entire asset portfolio, a pilot study shall be conducted on a

management and operations of acquisition or construction of representative sample of assets to determine if enhancements

the equipment and its use, maintenance, and modification and are needed to interval scales and scoring guidelines. The entire

its disposal when no longer required. asset portfolio should only be scored after a prioritizing

framework is established.

3.1.6 inconsistency measure, n—inconsistent scoring within

4.4 The API is a metric used to communicate the relative

asquarematrix(thesamenumberofcolumnsandrows,seethe

importance of equipment in terms of mission criticality, secu-

example in Appendix X1, Table X1.3) using a predefined

rity, or other measures important to the business entity. It

interval scale, for example, rating all comparisons high thus

disturbing the logic of the matrix. establishes a basis for evaluating asset utility.

3.1.7 interval scale, n—standard survey rating scale, based

5. Significance and Use

on real numbers, in which distances between data points are

5.1 The API is a metric used to communicate the relative

meaningful.

importance of equipment in terms of mission criticality, secu-

3.1.7.1 Discussion—Interval scales have no true zero point

rity, or other measures important to the business entity. It offers

so it is not possible to make statements about how many times

a method for ranking assets based on judgment/importance

higher one score is than another.

factors defined by the organization, creating information to

3.2 Acronyms:

justify compelling arguments for investment, security strate-

gies, and disposition plans.

AHP = Analytical hierarchy process 5.2 API also provides a quantitative basis for determining

API = Asset priority index

and documenting operational relationships between an asset

SME = Subject matter expert

portfolio and business objectives capital investment strategies,

deferred maintenance approaches, security design and analy-

4. Summary of Practice

ses, continuity of business/risk analyses, and disposition deci-

sions.

4.1 Asset prioritizing relies on the analytical hierarchy

5.3 It enables management to identify critical assets and

process (AHP), a proven decision-making aid, that provides

allocate resources appropriately and should therefore be an

managerswiththequantitativeinformationneededtoselectthe

integral process in equipment management.

best alternative or to rank/prioritize a set of alternatives.

4.1.1 AHP uses pair-wise comparison matrices (see the

6. Applicability

example inAppendix X1,Table X1.3) with judgment measure-

6.1 This practice may be applied to the entire asset portfolio

ments from a predefined survey scale to derive weights for the

of an entity or any subset in which identifying best alternatives

management-defined criteria used to evaluate assets.

or prioritizing a set of alternatives is imperative.

4.1.2 AHP pair-wise comparison matrices provide the crite-

6.2 The practice may be applied to a variety of scenarios

ria used in the asset prioritization methodology for ranking

because the criteria used to evaluate assets are selected by the

assets.(Thispracticecanbeusedtocategorizeassetsaccording

organization and are dependent on mission and the situational

to Practices E 2219, E 2220, and E 2221.)

study.

4.2 The asset prioritizing methodology follows six discrete

6.3 This practice may be applied to the entirety of the

steps:

entity’s equipment holdings or a clearly identified subset.

4.2.1 Step1:Developasetofcriticalcriteriathatanswerthe

6.4 The API for a portfolio can in turn be plotted against

prioritizing question (whether it is mission alignment, security

condition or security assessments to arrive at an investment,

requirements, and so forth). The criteria shall be mutually

disposition, or other business strategy.

exclusive and collectively exhaustive, that is, the criteria shall

address the most important decision-making factors without

7. Procedure

overlap.

7.1 The API criteria an organization selects shall reflect the

4.2.2 Step 2: Create an interval survey scale by which the

overall mission goals that the assets are to support. Criteria

criteria can be scored.

selection is usually a management function but shall (1) enjoy

4.2.3 Step 3: Assign weights to the criteria based on a

a consensus; (2) be well defined to facilitate scoring; (3) be

predefined scale of judgment or ratio measurements using the

mutually exclusive (definitions shall not overlap); and (4) be

AHP.

collectively exhaustive, that is, effectively cover those criteria

4.2.4 Step 4: Create scoring guidelines for subject matter

thatwillallowtheassetstosupportmissiongoals.Examplesof

experts (SME)s (preferably based on an interval scale with

API criteria include mission support, interchangeability, inter-

sufficient definition to support a wide gradation) so that the

ruptability, reliability, exclusivity, and asset potential future

scorers may can evaluate assets per according to the

need.

management-defined criteria.

7.2 Because the importance of each criterion element is

4.2.5 Step 5: Evaluate each asset according to each critical usually not equal, weights must be assigned to each element

criterion based on scoring guidelines. according to the input of management.

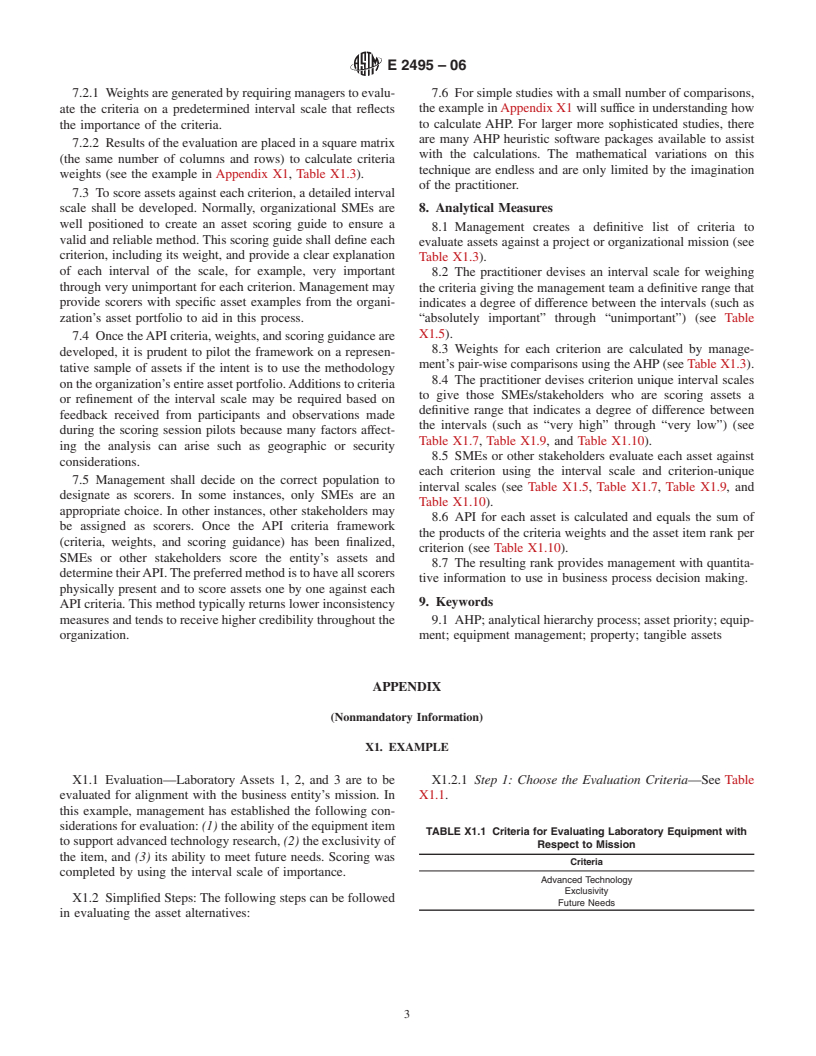

E2495–06

7.2.1 Weightsaregeneratedbyrequiringmanagerstoevalu- 7.6 For simple studies with a small number of comparisons,

ate the criteria on a predetermined interval scale that reflects the example inAppendix X1 will suffice in understanding how

to calculate AHP. For larger more sophisticated studies, there

the importance of the criteria.

are many AHP heuristic software packages available to assist

7.2.2 Results of the evaluation are placed in a square matrix

with the calculations. The mathematical variations on this

(the same number of columns and rows) to calculate criteria

technique are endless and are only limited by the imagination

weights (see the example in Appendix X1, Table X1.3).

of the practitioner.

7.3 To score assets against each criterion, a detailed interval

scale shall be developed. Normally, organizational SMEs are 8. Analytical Measures

well positioned to create an asset scoring guide to ensure a

8.1 Management creates a definitive list of criteria to

valid and reliable method. This scoring guide shall define each

evaluate assets against a project or organizational mission (see

criterion, including its weight, and provide a clear explanation

Table X1.3).

of each interval of the scale, for example, very important

8.2 The practitioner devises an interval scale for weighing

through very unimportant for each criterion. Management may the criteria giving the management team a definitive range that

provide scorers with specific asset examples from the organi-

indicates a degree of difference between the intervals (such as

zation’s asset portfolio to aid in this process. “absolutely important” through “unimportant”) (see Table

X1.5).

7.4 Once theAPI criteria, weights, and scoring guidance are

8.3 Weights for each criterion are calculated by manage-

developed, it is prudent to pilot the framework on a represen-

ment’s pair-wise comparisons using theAHP(see Table X1.3).

tative sample of assets if the intent is to use the methodology

8.4 The practitioner devises criterion unique interval scales

ontheorganization’sentireassetportfolio.Additionstocriteria

to give those SMEs/stakeholders who are scoring assets a

or refinement of the interval scale may be required based on

definitive range that indicates a degree of difference between

feedback received from participants and observations made

the intervals (such as “very high” through “very low”) (see

during the scoring session pilots because many factors affect-

Table X1.7, Table X1.9, and Table X1.10).

ing the analysis can arise such as geographic or security

8.5 SMEs or other stakeholders evaluate each asset against

considerations.

each criterion using the interval scale and criterion-unique

7.5 Management shall decide on the correct population to

interval scales (see Table X1.5, Table X1.7, Table X1.9, and

designate as scorers. In some instances, only SMEs are an

Table X1.10).

appropriate choice. In other instances, other stakeholders may

8.6 API for each asset is calculated and equals the sum of

be assigned as scorers. Once the API criteria framework

the products of the criteria weights and the asset item rank per

(criteria, weights, and scoring guidance) has been finalized,

criterion (see Table X1.10).

SMEs or other stakeholders score the entity’s assets and

8.7 The resulting rank provides management with quantita-

determinetheirAPI.Thepreferredmethodistohaveallscorers

tive information to use in business process decision making.

physically present and to score assets one by one against each

9. Keywords

API criteria.This method typically returns lower inconsistency

measures and tends to receive higher credibility throughout the

9.1 AHP; analytical hierarchy process; asset priority; equip-

organization. ment; equipment management; property; tangible assets

APPENDIX

(Nonmandatory Information)

X1. EXAMPLE

X1.1 Evaluation—Laboratory Assets 1, 2, and 3 are to be X1.2.1 Step 1: Choose the Evaluation Criteria—See Table

evaluated for alignment with the business entity’s mission. In X1.1.

this example, management has established the following con-

siderations for evaluation: (1) the ability of the equipment item

TABLE X1.1 Criteria for Evaluating Laboratory Equipment with

to support advanced technology research, (2) the exclusivity of

Respect to Mission

the item, and (3) its ability to meet future needs. Scoring was

Criteria

completed by using the interval scale of importance.

Advanced Technology

Exclusivity

X1.2 Simplified Steps: The following steps can be followed

Future Needs

in evaluating the asset alternatives:

E2495–06

TABLE X1.3 Computing Relative Weights for Asset Evaluation

X1.2.2 Step 2: Design an Evaluation Scale—The scale

Criteria

shown in Table X1.2 displays the interval scale designed to

Advanced Exclusivity Future Geometric Normalized

de

...

Questions, Comments and Discussion

Ask us and Technical Secretary will try to provide an answer. You can facilitate discussion about the standard in here.