ISO 15663-2:2001

(Main)Petroleum and natural gas industries — Life-cycle costing — Part 2: Guidance on application of methodology and calculation methods

Petroleum and natural gas industries — Life-cycle costing — Part 2: Guidance on application of methodology and calculation methods

This part of ISO 15663 provides guidance on application of the methodology for life-cycle costing for the development and operation of facilities for drilling, production and pipeline transportation within the petroleum and natural gas industries. This part of ISO 15663 also provides guidance on the application and calculations of the life-cycle costing process defined in ISO 15663-1.[1] This part of ISO 15663 is not concerned with determining the life-cycle cost of individual items of equipment, but rather with life-cycle costing in order to estimate the cost differences between competing project options.

Industries du pétrole et du gaz naturel — Estimation des coûts globaux de production et de traitement — Partie 2: Lignes directrices relatives à l'application de la méthodologie et aux méthodes de calcul

General Information

Relations

Standards Content (Sample)

INTERNATIONAL ISO

STANDARD 15663-2

First edition

2001-09-01

Petroleum and natural gas industries —

Life-cycle costing —

Part 2:

Guidance on application of methodology

and calculation methods

Industries du pétrole et du gaz naturel — Estimation des coûts globaux de

production et de traitement —

Partie 2: Lignes directrices relatives à l'application de la méthodologie et

aux méthodes de calcul

Reference number

ISO 15663-2:2001(E)

© ISO 2001

---------------------- Page: 1 ----------------------

ISO 15663-2:2001(E)

PDF disclaimer

This PDF file may contain embedded typefaces. In accordance with Adobe's licensing policy, this file may be printed or viewed but shall not be

edited unless the typefaces which are embedded are licensed to and installed on the computer performing the editing. In downloading this file,

parties accept therein the responsibility of not infringing Adobe's licensing policy. The ISO Central Secretariat accepts no liability in this area.

Adobe is a trademark of Adobe Systems Incorporated.

Details of the software products used to create this PDF file can be found in the General Info relative to the file; the PDF-creation parameters

were optimized for printing. Every care has been taken to ensure that the file is suitable for use by ISO member bodies. In the unlikely event

that a problem relating to it is found, please inform the Central Secretariat at the address given below.

© ISO 2001

All rights reserved. Unless otherwise specified, no part of this publication may be reproduced or utilized in any form or by any means, elec-

tronic or mechanical, including photocopying and microfilm, without permission in writing from either ISO at the address below or ISO's mem-

ber body in the country of the requester.

ISO copyright office

Case postale 56 • CH-1211 Geneva 20

Tel. + 41 22 749 01 11

Fax + 41 22 749 09 47

E-mail copyright@iso.ch

Web www.iso.ch

Printed in Switzerland

©

ii ISO 2001 – All rights reserved

---------------------- Page: 2 ----------------------

ISO 15663-2:2001(E)

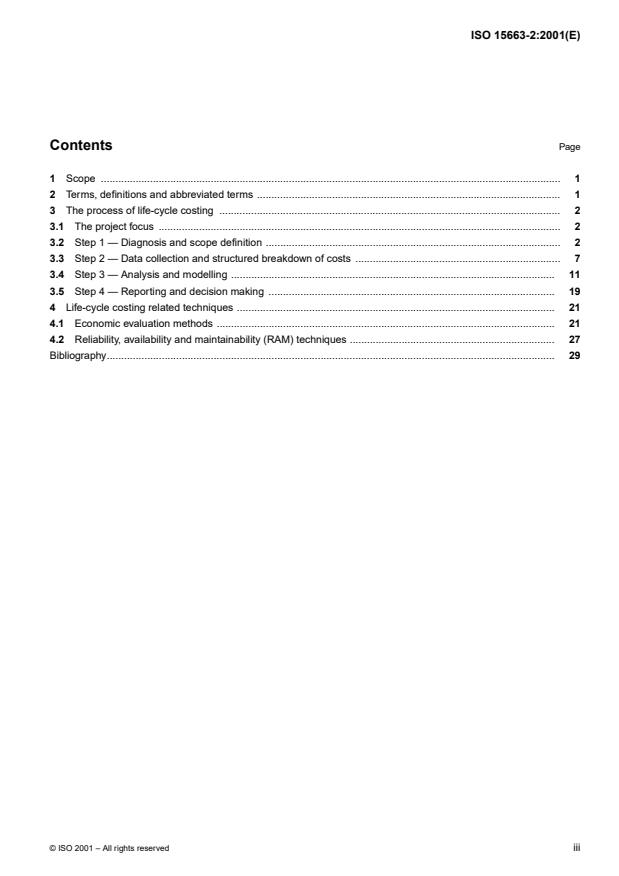

Contents Page

1 Scope . 1

2 Terms, definitions and abbreviated terms . 1

3 The process of life-cycle costing . 2

3.1 The project focus . 2

3.2 Step 1 — Diagnosis and scope definition . 2

3.3 Step 2 — Data collection and structured breakdown of costs . 7

3.4 Step 3 — Analysis and modelling . 11

3.5 Step 4 — Reporting and decision making . 19

4 Life-cycle costing related techniques . 21

4.1 Economic evaluation methods . 21

4.2 Reliability, availability and maintainability (RAM) techniques . 27

Bibliography. 29

©

ISO 2001 – All rights reserved iii

---------------------- Page: 3 ----------------------

ISO 15663-2:2001(E)

Foreword

ISO (the International Organization for Standardization) is a worldwide federation of national standards bodies (ISO

member bodies). The work of preparing International Standards is normally carried out through ISO technical

committees. Each member body interested in a subject for which a technical committee has been established has

the right to be represented on that committee. International organizations, governmental and non-governmental, in

liaison with ISO, also take part in the work. ISO collaborates closely with the International Electrotechnical

Commission (IEC) on all matters of electrotechnical standardization.

International Standards are drafted in accordance with the rules given in the ISO/IEC Directives, Part 3.

Draft International Standards adopted by the technical committees are circulated to the member bodies for voting.

Publication as an International Standard requires approval by at least 75 % of the member bodies casting a vote.

Attention is drawn to the possibility that some of the elements of this part of ISO 15663 may be the subject of patent

rights. ISO shall not be held responsible for identifying any or all such patent rights.

International Standard ISO 15663-2 was prepared by Technical Committee ISO/TC 67, Materials, equipment and

offshore structures for petroleum and natural gas industries.

ISO 15663 consists of the following parts, under the general title Petroleum and natural gas industries — Life-cycle

costing:

— Part 1: Methodology

— Part 2: Guidance on application of methodology and calculation methods

— Part 3: Implementation guidelines

©

iv ISO 2001 – All rights reserved

---------------------- Page: 4 ----------------------

ISO 15663-2:2001(E)

Introduction

This part of ISO 15663 was developed in order to encourage the adoption of a common and consistent approach to

life-cycle costing within the petroleum and natural gas industries. This will occur faster and more effectively if a com-

mon approach is agreed internationally.

This part of ISO 15663 has been prepared to provide guidance on the application of the methodology given in

ISO 15663-1 [1] and on the calculations related to it.

It provides practical guidance towards the individual steps of the life-cycle costing process and aims to

— show how the potentials for added value can be achieved without life-cycle costing turning into a costly and

time-consuming process;

— indicate how to structure the work within the process and define focus areas;

— transfer the experience of industry in applying the methodology, so that a common and consistent approach can

be achieved.

It also promotes an understanding of the related methodologies and techniques and their application within the

life-cycle costing framework.

Life-cycle costing is distinct from investment appraisal in that it is not concerned with determining the financial

viability of a development. It is concerned only with determining the differences between competing options and

establishing the options which best meet the owner’s business objectives.

This part of ISO 15663 is based on the principles defined in IEC 60300-3-3, Dependability management — Part 3:

Application guide — Section 3: Life cycle costing.

©

ISO 2001 – All rights reserved v

---------------------- Page: 5 ----------------------

INTERNATIONAL STANDARD ISO 15663-2:2001(E)

Petroleum and natural gas industries — Life-cycle costing —

Part 2:

Guidance on application of methodology and calculation methods

1 Scope

This part of ISO 15663 provides guidance on application of the methodology for life-cycle costing for the development

and operation of facilities for drilling, production and pipeline transportation within the petroleum and natural gas in-

dustries.

This part of ISO 15663 also provides guidance on the application and calculations of the life-cycle costing process

[1]

defined in ISO 15663-1.

This part of ISO 15663 is not concerned with determining the life-cycle cost of individual items of equipment, but

rather with life-cycle costing in order to estimate the cost differences between competing project options.

2 Terms, definitions and abbreviated terms

For the purposes of this part of ISO 15663, the following terms, definitions and abbreviated terms apply.

2.1 Terms and definitions

2.1.1

initial investment

investment outlay for a project

NOTE Also known as CAPEX.

2.1.2

present value

value of the project cash flow excluding the initial investment outlay

2.1.3

life-cycle costing

process of evaluating the difference between the life-cycle costs of two or more alternative options

2.2 Abbreviated terms

CAPEX capital expenditure

FMECA failure mode effect and criticality analysis

FV future value

H,S&E health, safety and environment

IRR internal rate of return

NPV net present value

©

ISO 2001 – All rights reserved 1

---------------------- Page: 6 ----------------------

ISO 15663-2:2001(E)

OPEX operating expenditure

®

OREDA offshore reliability database

PI profitability index

PV present value

RAM reliability, availability and maintainability

RCM reliability-centred maintenance

TTE tools and test equipment

WACC weighted average capital cost

3 The process of life-cycle costing

3.1 The project focus

[1]

This subclause provides a guideline for the different steps of the methodology described in ISO 15663-1 . It should

be recognized that the contribution of life-cycle costing to a project is no more or less important than that made by

other support functions such as design, reliability or engineering.

Each of these functions provides its own unique perspective on the problem and each examines some aspects of

performance. Life-cycle costing adds a long-term financial perspective and provides the means to

— predict financial performance through life on a quantitative basis,

— assess the financial implications of the contributions made by other functions,

— compare alternative options on a common financial basis.

Life-cycle costing cannot act in isolation and should interact with the other functions as part of the team approach.

3.2 Step 1 — Diagnosis and scope definition

3.2.1 Identify objectives

The objectives should be established through discussion with stakeholders and other members of the team,

particularly the manager responsible for the overall work.

Two important aspects need to be established.

a) What are we looking at?

This provides the focus for the work and should establish what functions, systems or equipment are being examined.

b) Why are we looking at it?

This establishes the reason for the work.

These questions can be used to allow the user to relate the life-cycle costing work to the objectives.

Simple examples might be as follows.

EXAMPLE 1 What — a pumping system is being examined. Why — because the hydrocarbons need to be moved from one

location to another.

©

2 ISO 2001 – All rights reserved

---------------------- Page: 7 ----------------------

ISO 15663-2:2001(E)

The objective that life-cycle costing should address is the function of transferring the flow, and a pumping system may

only be one of several options.

EXAMPLE 2 What — maintenance costs across the platform. Why — because maintenance is considered excessive or unless

maintenance costs are reduced, production may be terminated early.

If a decision has already been taken to focus on maintenance and exclude other elements of OPEXs, this should be

questioned. The objective of life-cycle costing is confirm the significant platform cost drivers and then assist in

quantifying the opportunities for reducing costs.

EXAMPLE 3 What — gas compression. Why — there are gas reserves to exploit.

This is sufficient, the objective has been identified and a technical need already established for gas compression.

This would lead into identification of the options available. The objective of life-cycle costing is to support the

evaluation of alternative methods for compression.

EXAMPLE 4 What — a 20 MW power generation package. Why — a response should be made to a formal invitation to tender

that includes life-cycle costing requirements.

The objective is not to provide a response to a tender, but to produce a winning bid, the discussion should now focus

on how the bid team can use life-cycle costing to advantage.

In subsequent iterations of the process, this task may be limited to reconfirmation. However, it may be found that the

life-cycle costing work changes the overall objective. Taking, as an example, maintenance cost optimization, the first

iteration may show that downtime (lost production) is the cost driver, not maintenance costs.

3.2.2 Identification of constraints

The relevant constraints will arise from three principal sources as follows:

— project constraints on what can be achieved within the life-cycle costing work;

These will arise from resource and time scale limitations of the work. A typical example would be the need to change

the contracted specification during construction and hook-up. This might require a response in a few days, or at least

a couple of weeks. The life-cycle costing approach should be tailored to this time scale (“quick and dirty”). This may

mean a go/no go response, i.e. either the change has little impact on life-cycle costs or it has a significant impact.

Generally, where there is a constraint on either the time or resources available to undertake the work, the level of

detail should be reduced and not the number of options considered.

— technical constraints which limit the options available;

EXAMPLE A change to an existing facility that requires additional equipment means there may be topside weight and space

constraints on the options, or an operator may be constrained to certain technical options;

— budgetary constraints.

There may exist limitations on CAPEX or alternatively, the outcome may be subject to hurdle rates, e.g. an option

must achieve an IRR of 10 % before it merits further consideration.

Constraints can be imposed by third parties or other external influences. Examples of such constraints are

environment discharge or health and safety issues.

3.2.3 Establishment of decision criteria

3.2.3.1 General

For life-cycle costing within the oil and gas industry, the decision criteria selected should always reflect the corporate

requirements of the end user, generally the operator. At a lower level, additional considerations may be associated

with the contractor's or vendor's corporate objectives. In an alliance partnership, the criteria will need to be agreed by

all partners.

©

ISO 2001 – All rights reserved 3

---------------------- Page: 8 ----------------------

ISO 15663-2:2001(E)

In defining the decision criteria, reference should always be made to the originator or customer, both to establish the

criteria and to ensure there is sufficient understanding as to how to apply them. The user's understanding is not

simply limited to technical comprehension, but should also include an agreement as to how criteria should be used

to select options.

3.2.3.2 Measure economic evaluation method

The measure that is selected should enable alignment of technical decisions with corporate objectives. It should

therefore be a structured approach for defining the economic impact of technical decisions.

The most common measures are described in clause 4. These are:

—NPV;

— life-cycle cost;

— IRR;

—PI;

— the payback method;

— break-even;

— cost per standard barrel of oil.

The selection of measure depends on the item under consideration and on which phase or iteration the project has

entered. For the first iterations of the life-cycle costing process, the object investigated is the field development itself

or the development concept. The revenue stream in total can be dedicated to this object. All the traditional economic

evaluation methods can therefore be applied.

For the further iterations, the concept is broken down into the individual systems and further into equipment units. For

these iterations no particular part of the revenue can be related to the object under consideration. The measure of

life-cycle cost can then be applied. Through minimizing the total life-cycle cost of an asset or a function, where impact

on the revenue stream of failures occurring are taken into consideration as a cost, asset value can be maximized in

a consistent manner.

For these later iterations NPV and IRR can be applied when evaluating additional CAPEX resulting in reduced

OPEX. The difference between the options of making the investment or not can then be considered as an investment

appraisal evaluation.

An example of application of different measures or criteria is shown in Figure 1.

In the process of life-cycle costing, often only the difference between various options for filling a function can be

evaluated. The possible measures that can be applied are then reduced to NPV or life-cycle cost, since the others

listed are calculated from the total cost and revenue stream associated with the decision.

3.2.3.3 Assumptions

The assumptions that are set for calculations are vital for the evaluation of alternatives in order to determine which

gives the highest added value. The most important assumptions are listed in Table 1. The areas to be aware of for

calculations are addressed under 3.4.1.

©

4 ISO 2001 – All rights reserved

---------------------- Page: 9 ----------------------

ISO 15663-2:2001(E)

Figure 1 — Asset boundaries and evaluation of functional requirements

Table 1 — Assumptions

— Timing

— Investment year

— Start of operation

How costs during operation are

weighed against the initial investment

— Life of field

— Discount rate

Which is the best system

solution/equipment alternative?

— Pre-tax / After-tax-calculations

— Output requirement over time

The impact of improving efficiency

—Costofpower

— Production profile

The potential cost of failures

— Criticality

©

ISO 2001 – All rights reserved 5

---------------------- Page: 10 ----------------------

ISO 15663-2:2001(E)

3.2.4 Identify potential options

Options and sub-options for the function under review should be considered by a multidisciplinary team.

The use of a facilitator who can structure the meeting and log all options generated by the team can significantly

improve the quality of the exercise. A well-proven technique to generate options and identify cost drivers is a

functional/cost analysis of the investment. This technique is part of value engineering or functional value analysis

workshops. Reference is made to clause 4. In function/cost analysis, a multidisciplinary team establishes the main

functions of the investment and then establishes the sub-functions for the main functions. The equipment options for

each sub-function are then identified and evaluated by the team. The evaluation of options will normally be in two

stages: initial evaluation is carried out on a qualitative basis and some options may be evaluated from further study.

Remaining options after the first screening are evaluated by undertaking life-cycle costing. Option generation and

evaluation are normally carried out in distinct phases to ensure that evaluation does not inhibit the option generation

process.

3.2.5 Establish options

Establishing the potential options implies screening the options arising from the previous task. The work can be

carried out as the second half of the function/cost analysis, carried out in a full value engineering or functional value

analysis workshop. This can save time and effort, and the ideas from the brainstorming are still fresh in people’s

minds.

The screening process should be applied consistently, in that each option should be subject to the same assessment

criteria. A typical range of screening criteria may include the following questions:

— Is it technically feasible?

—Isitpractical?

— Is it too expensive?

— Can it meet the programme?

— Can it meet the HS&E programme?

— Are the risks acceptable (technical, financial, revenue)?

— Is it consistent with corporate policy and is it acceptable to our partner?

— Can we evaluate it?

3.2.6 Define costs to be included in the analysis

To identify the cost elements related to an asset or a system, the function of the asset and the

interrelations/dependencies toward the other systems should be evaluated.

Evaluation of operation can be in terms of what should be added to get the right output. This may include

— output requirements,

— power requirement,

— requirement of utilities/support systems,

— downstream effect of efficiency, resistance, etc.

Evaluation of maintenance can be in terms of what should be added to keep the process going. This may include

— regularity requirements for the system,

— maintenance concept/workload.

Revenue impact can be evaluated in terms of the consequence of failures.

©

6 ISO 2001 – All rights reserved

---------------------- Page: 11 ----------------------

ISO 15663-2:2001(E)

ISO 15663-1 [1] describes the approach that should be followed. The output from these activities is a list of cost is-

sues for possible inclusion in the assessment, and taken together they define the life-cycle cost boundary. They need

to be agreed among the team members.

3.3 Step 2 — Data collection and structured breakdown of costs

3.3.1 Identify potential cost drivers

A key issue within life-cycle costing is to keep the focus on the cost drivers, the major cost elements. What constitutes

the largest costs can come as a surprise if similar assets have not been evaluated earlier.

Thecostdrivers vary accordingto

— application,

— equipment type,

— equipment configuration.

For the offshore oil industry, the major cost elements are normally found among

— CAPEX,

— OPEX,

— maintenance cost,

— revenue impact of failures leading to production shutdown.

A cost driver can be one dominating cost or a combination.

All the basic information required to undertake this step is established in the previous step. In this task the user

should take the list from the previous task, and for each option review each cost issue to determine if it is likely to be

a life-cycle cost driver. This is an attempt to second-guess the outcome of the assessment. To assist in this process,

it may be convenient to group the issues under related headings.

Useful tools in determining the cost drivers can be FMECA or a functional value analysis, as described in clause 4.

The outcome of this task will be the list of cost issues, but with the potential drivers highlighted.

3.3.2 Define cost elements

This task pursues the focus of the previous task, in that its principal aim is to identify the minimum level of detail

necessary to discriminate between options. Although all the cost issues identified during Step 1 need to be

addressed and estimated, effort in this task should be concentrated on identifying the cost elements required for the

potential cost drivers.

The approach for each cost driver should be to consider the minimum number of cost elements required to estimate

the cost driver.

The remaining cost issues should be considered in terms of whether can they be estimated directly, i.e. are they cost

elements, and is it possible to group any of the cost issues under single headings.

The aim of the work is to identify the minimum number of cost elements, so that sensitivity analysis can be conducted

on the cost drivers, and to reduce the effort associated with the remaining cost issues. A candidate list of cost

elements is provided in 4.1.3.

©

ISO 2001 – All rights reserved 7

---------------------- Page: 12 ----------------------

ISO 15663-2:2001(E)

The important features of the task are that it starts the user thinking about

— how the costs are calculated in the model,

— how sensitivity analysis will be accommodated, with the focus on the cost drivers,

— the practical issues associated with data collection, such as its availability, its quality and to whom the user needs

to talk. It also provides an insight into the amount of effort likely to be required and how this may be tailored to the

available resources.

The focus of the evaluation should be on differences between alternatives. Cost elements that are the same for all

alternatives can normally be excluded.

This work provides the user with an agenda for the discussion that will follow on the structured breakdown of costs.

3.3.3 Establish structured breakdown of costs

The objective of this task is to align the need for information, as defined by the cost elements, with the ability of the

organisation to respond.

All main elements of life-cycle cost should be considered, i.e. CAPEX, OPEX, revenue impact and commissioning

cost.

The cost elements should be structured taking into account

— the way in which costs are acquired and recorded,

— the way cost elements are calculated.

The output from the task will be an agreed structured breakdown of costs.

3.3.4 Identify and collect data

3.3.4.1 General

The structured breakdown of costs identifies the cost data required. Of necessity, the previous discussions defining

the structured breakdown of costs will have addressed practical issues such as the data sources.

A data collection procedure should be identified and defined.

The aim of setting up and implementing a procedure for collecting data is to

— define data requirements for life-cycle costing analysis,

— identify the sources from which to obtain data,

— establish the necessary level of quality control.

3.3.4.2 Data generation

This subclause outlines the sources from which the input data for the calculations can normally be obtained.

As a general statement, most data that are to be used in life-cycle costing analysis can be retrieved in the following

two basic forms:

a) paper-based;

b) computer-based.

©

8 ISO 2001 – All rights reserved

---------------------- Page: 13 ----------------------

ISO 15663-2:2001(E)

Appropriate data can be obtained from operators, contractors and vendors, in either format from their existing

sources and databases, such as:

— accounting and financing system;

— purchasing system;

— engineering system;

— maintenance management system;

— reliability management system.

Data for CAPEXs can be:

— design and administration man-hours;

— equipment and material purchase;

— fabrication cost;

— installation cost;

— commissioning cost;

— insurance spares cost;

— reinvestment cost.

For new equipment, adjustments should be made from comparison with similar existing equipment.

Data for OPEXs can be:

— man-hours per system;

— spare parts consumption per system;

— logistic support cost;

— energy consumption cost;

— insurance cost;

— onshore support cost.

Data for revenue impact can be failure data. The following types of data can be extracted or referenced using

®

OREDA :

— inventory data, covering the identification information of the equipment of concern, including the design

characteristics, the environment and the operation conditions;

— operating data, that are necessary for calculating the failure rates (calendar/operating time, number of

demands);

— failure event data, including failure rate, failure mode, the subsystem/item failed, the degree of failure (severity

®

class, according to OREDA terminology);

— maintenance data, including the type of maintenance, the repair activity, the downtime/repair time, maintenance

program/interval, the resources required (which are very useful for estimating OPEXs).

Revenue impact is based on the production profile given in the plan for development and operation. For fields already

in operation, actual and predicted future production form the basis.

©

ISO 2001 – All rights reserved 9

---------------------- Page: 14 ----------------------

ISO 15663-2:2001(E)

3.3.4.3 Data quality and adjustment

3.3.4.3.1 Data adjustment

3.3.4.3.1.1 General

Historic data should be adjusted for differences in system design and capacity, difference in oil characteristics, time

in operation, monetary inflation/deflation, and cost development over time/trend prediction.

3.3.4.3.1.2 System design and capacity

Adjustment should be made for significant differences in system design and in different number of equipment units

within the system to be evaluated, and the source of the historic data for the existing systems.

3.3.4.3.1.3 Oil characteristics

Adjustment should be made for significant differences in expected lifetime or failure frequencies for equipment due to

characteristics of the oil or fluid handled.

3.3.4.3.1.4 Time in operation

Failures normally are more frequent early in operation (running-in period), and after long times in operation when the

equipment is starting to deteriorate. Adjustment should be made for the operating phase of the reference systems

and equipment.

Due to product development and feedback to the vendors, equipment quality normally improves over time.

Adjustment of historic data should be made for significant design improvements.

3.3.4.3.1.5 Monetary inflation/deflation

Adjustment should be made for cost differences due to monetary inflation/deflation occurring between the historic

records and the time of investment.

For cost adjustment, the cost index for the oil industry over the relevant years should be used.

3.3.4.3.1.6 Forecasting cost development

When the time span from the evaluation to cost occurrence and the deviation between cost development rate and the

inflation rate are significant, methods for trend prediction should be used to forecast future cost development.

For expected cost development close to the inflation rate:

a) adjustments of the costs per year for inflation should be performed when using a nominal discount rate;

b) adjustment for inflation should not be done when using a real-term interest rate.

3.3.4.3.2 Data qualification

The sample of historic data should be large enough to obtain data of acceptable accuracy in relation to the decision

to be made.

Man-hours and spare parts consumption should be averaged over enough years to give a calculation of sufficient

accuracy.

©

10 ISO 2001 – All rights reserved

---------------------- Page: 15 ----------------------

ISO 1

...

Questions, Comments and Discussion

Ask us and Technical Secretary will try to provide an answer. You can facilitate discussion about the standard in here.