SIST ISO 31000:2018

Risk management - Guidelines

Risk management - Guidelines

ISO 31000:2018 provides guidelines on managing risk faced by organizations. The application of these guidelines can be customized to any organization and its context.

ISO 31000:2018 provides a common approach to managing any type of risk and is not industry or sector specific.

ISO 31000:2018 can be used throughout the life of the organization and can be applied to any activity, including decision-making at all levels.

Management du risque -- Lignes directrices

ISO 31000:2018 fournit des lignes directrices concernant le management du risque auquel sont confrontés les organismes. L'application de ces lignes directrices peut être adaptée à tout organisme et à son contexte.

ISO 31000:2018 fournit une approche générique permettant de gérer toute forme de risque et n'est pas spécifique à une industrie ou un secteur.

ISO 31000:2018 peut être utilisé tout au long de la vie de l'organisme et peut être appliqué à toute activité, y compris la prise de décisions à tous les niveaux.

Obvladovanje tveganja - Smernice

Ta dokument zagotavlja smernice o obvladovanju tveganja, s katerim se soočajo organizacije. Uporabo teh smernic je mogoče prilagoditi vsaki organizaciji in njenemu kontekstu.

Ta dokument zagotavlja splošni pristop k obvladovanju vseh vrst tveganja in ni specifičen za neko industrijo ali sektor.

Ta dokument se lahko uporablja v celotnem življenju organizacije in za katerokoli aktivnost, vključno s sprejemanjem odločitev na vseh ravneh.

General Information

Relations

Standards Content (Sample)

SLOVENSKI STANDARD

01-maj-2018

Obvladovanje tveganja - Smernice

Risk management - Guidelines

Management du risque -- Lignes directrices

Ta slovenski standard je istoveten z: ISO 31000:2018

ICS:

03.100.01 Organizacija in vodenje Company organization and

podjetja na splošno management in general

2003-01.Slovenski inštitut za standardizacijo. Razmnoževanje celote ali delov tega standarda ni dovoljeno.

INTERNATIONAL ISO

STANDARD 31000

Second edition

2018-02

Risk management — Guidelines

Management du risque — Lignes directrices

Reference number

©

ISO 2018

© ISO 2018

All rights reserved. Unless otherwise specified, or required in the context of its implementation, no part of this publication may

be reproduced or utilized otherwise in any form or by any means, electronic or mechanical, including photocopying, or posting

on the internet or an intranet, without prior written permission. Permission can be requested from either ISO at the address

below or ISO’s member body in the country of the requester.

ISO copyright office

CP 401 • Ch. de Blandonnet 8

CH-1214 Vernier, Geneva

Phone: +41 22 749 01 11

Fax: +41 22 749 09 47

Email: copyright@iso.org

Website: www.iso.org

Published in Switzerland

ii © ISO 2018 – All rights reserved

Contents Page

Foreword .iv

Introduction .v

1 Scope . 1

2 Normative references . 1

3 Terms and definitions . 1

4 Principles . 2

5 Framework . 4

5.1 General . 4

5.2 Leadership and commitment . 5

5.3 Integration . 5

5.4 Design . 6

5.4.1 Understanding the organization and its context . 6

5.4.2 Articulating risk management commitment . 6

5.4.3 Assigning organizational roles, authorities, responsibilities and accountabilities 7

5.4.4 Allocating resources. 7

5.4.5 Establishing communication and consultation . 7

5.5 Implementation . 7

5.6 Evaluation . 8

5.7 Improvement . 8

5.7.1 Adapting . 8

5.7.2 Continually improving . 8

6 Process . 8

6.1 General . 8

6.2 Communication and consultation . 9

6.3 Scope, context and criteria . .10

6.3.1 General.10

6.3.2 Defining the scope .10

6.3.3 External and internal context .10

6.3.4 Defining risk criteria.10

6.4 Risk assessment .11

6.4.1 General.11

6.4.2 Risk identification .11

6.4.3 Risk analysis .12

6.4.4 Risk evaluation .12

6.5 Risk treatment .13

6.5.1 General.13

6.5.2 Selection of risk treatment options .13

6.5.3 Preparing and implementing risk treatment plans .14

6.6 Monitoring and review .14

6.7 Recording and reporting .14

Bibliography .16

Foreword

ISO (the International Organization for Standardization) is a worldwide federation of national standards

bodies (ISO member bodies). The work of preparing International Standards is normally carried out

through ISO technical committees. Each member body interested in a subject for which a technical

committee has been established has the right to be represented on that committee. International

organizations, governmental and non-governmental, in liaison with ISO, also take part in the work.

ISO collaborates closely with the International Electrotechnical Commission (IEC) on all matters of

electrotechnical standardization.

The procedures used to develop this document and those intended for its further maintenance are

described in the ISO/IEC Directives, Part 1. In particular the different approval criteria needed for the

different types of ISO documents should be noted. This document was drafted in accordance with the

editorial rules of the ISO/IEC Directives, Part 2 (see www .iso .org/ directives).

Attention is drawn to the possibility that some of the elements of this document may be the subject of

patent rights. ISO shall not be held responsible for identifying any or all such patent rights. Details of

any patent rights identified during the development of the document will be in the Introduction and/or

on the ISO list of patent declarations received (see www .iso .org/ patents).

Any trade name used in this document is information given for the convenience of users and does not

constitute an endorsement.

For an explanation on the voluntary nature of standards, the meaning of ISO specific terms and

expressions related to conformity assessment, as well as information about ISO’s adherence to the

World Trade Organization (WTO) principles in the Technical Barriers to Trade (TBT) see the following

URL: www .iso .org/ iso/ foreword .html.

This document was prepared by Technical Committee ISO/TC 262, Risk management.

This second edition cancels and replaces the first edition (ISO 31000:2009) which has been technically

revised.

The main changes compared to the previous edition are as follows:

— review of the principles of risk management, which are the key criteria for its success;

— highlighting of the leadership by top management and the integration of risk management, starting

with the governance of the organization;

— greater emphasis on the iterative nature of risk management, noting that new experiences,

knowledge and analysis can lead to a revision of process elements, actions and controls at each

stage of the process;

— streamlining of the content with greater focus on sustaining an open systems model to fit multiple

needs and contexts.

iv © ISO 2018 – All rights reserved

Introduction

This document is for use by people who create and protect value in organizations by managing risks,

making decisions, setting and achieving objectives and improving performance.

Organizations of all types and sizes face external and internal factors and influences that make it

uncertain whether they will achieve their objectives.

Managing risk is iterative and assists organizations in setting strategy, achieving objectives and making

informed decisions.

Managing risk is part of governance and leadership, and is fundamental to how the organization is

managed at all levels. It contributes to the improvement of management systems.

Managing risk is part of all activities associated with an organization and includes interaction with

stakeholders.

Managing risk considers the external and internal context of the organization, including human

behaviour and cultural factors.

Managing risk is based on the principles, framework and process outlined in this document, as

illustrated in Figure 1. These components might already exist in full or in part within the organization,

however, they might need to be adapted or improved so that managing risk is efficient, effective and

consistent.

d

Figure 1 — Principles, framework and process

INTERNATIONAL STANDARD ISO 31000:2018(E)

Risk management — Guidelines

1 Scope

This document provides guidelines on managing risk faced by organizations. The application of these

guidelines can be customized to any organization and its context.

This document provides a common approach to managing any type of risk and is not industry or sector

specific.

This document can be used throughout the life of the organization and can be applied to any activity,

including decision-making at all levels.

2 Normative references

There are no normative references in this document.

3 Terms and definitions

For the purposes of this document, the following terms and definitions apply.

ISO and IEC maintain terminological databases for use in standardization at the following addresses:

— ISO Online browsing platform: available at http:// www .iso .org/ obp

— IEC Electropedia: available at http:// www .electropedia .org

3.1

risk

effect of uncertainty on objecti

...

ةيلودلا ةفصاوملا

ISO

يناثلا رادصلإا

2302/2

ةٌمسرلا ةمجرتلا

Official translation

Traductionofficielle

ةيهيجوتلا ةلدلأا - رطاخملا ةرادإ

Risk management — Guidelines

Management du risque — Lignes

directrices

بهزًجرر ذًر خًُضر خُثرػ خًجرزك ارطَىض ، فُُج ٍف ISO خَسكرًنا خَبيلأا ٍف ذؼجغ

262ISO TC رغبخًنا حرادلإ خُُفنا خُجهنا ٍف خُثرؼنا خًجرزنا مًػ خػىًجي مجل ٍي

1/ATTF

ًؼجرًنا ىلرنا

ISO 3100002013 (A)

خًُضرنا خًجرزنا

©ISO 2013

)ع( 2013031000 وسَلأا

:تفصإًنا ِذْ ثذًتعا يتنا تيبزعنا شييقتنا ثآج

ٌدرلأا خَُدرلأا صَُبمًناو دبفصاىًنا خطضؤي

داربيلأا صَُبمًناو دبفصاىًهن داربيلأا خئُھ

رئاسجنا صُُمزهن ٌرئاسجنا ذهؼًنا

خَدىؼطنا صَُبمًناو دبفصاىًهن خَدىؼطنا خئُهنا

قارؼنا خُػىُنا حرطُطناو صُُمزهن ٌسكرًنا زبهجنا

ذَىكنا خػبُصهن خيبؼنا خئُهنا

ٌادىطنا صَُبمًناو دبفصاىًهن خَُادىطنا خئُهنا

ًٍُنا حدىجنا ػجظو صَُبمًناو دبفصاىًهن خًُُُنا خئُهنا

صَىر خُػبُصنا خُكهًناو دبفصاىًهن ًُغىنا ذهؼًنا

بَرىض خَرىطنا خُثرؼنا صَُبمًناو دبفصاىًنا خئُھ

بُجُن خُضبُمنا رَُبؼًناو دبفصاىًهن ًُغىنا سكرًنا

رصي حدىجناو دبفصاىًهن خيبؼنا خَرصًنا خئُهنا

زشُنأ عبطنا قٕقد تياًد تقيثٔ

©2013 وسَأ

همادختسا وأ روشنملا اذه نم ءزج يأ جاتنإ ةداعإ زوجٌ لا ، هذٌفنت قاٌس ًف ًابولطم وأ ، كلذ فلاخ ىلع صنٌ مل ام .ةظوفحم قوقحلا عٌمج

. قبسم نذإ نود تنارتنلاا وأ تنرتنلاا ىلع رشنلا وأ وأ خسنلا كلذ ًف امب ، ةٌكٌناكٌم وأ ةٌنورتكلإ ، ةلٌسو يأب وأ لكش يأب ىرخأ ةقٌرطب

.ةبلاطلا ةھجلا ةلود ًف سٌٌقتلل ةٌلودلا ةمظنملا ًف ءاضعلأا تائٌھلا ىدحإ نم وأ هاندأ ناونعلا ىلع ISO ـلا نم امإ نذلإا بلط نكمٌ

صُُمزهن خُنوذنا خًظًُنا خُكهي قىمح تزكي

CP 401. Ch. De Blandonnet 3

CH-1214 Vernier, Geneva, Switzerland

004122٧4٢0111 :فربھ

004122٧4٢0٢4٧ :صكبف

copyright@iso.org :ٍَورزكنا ذَرث

www.iso.org :ٍَورزكنلأا غلىًنا

2021 وبػ ٍف0 خُثرؼنا خخطُنارشَ ىر

ارطَىض ٍف رشُنا ىر

ِ

و

)ع( 02813:8222 زيا

سزٓفنا

IV . : ذيًٓت

V . :تيذقًنا

VI . تيٓيجٕتنا تندلأا - زطاخًنا ةرادإ

1 . :قاطُنا .1

VI . :تيضييقتنا عجازًنا .2

VI . :ثافيزعتنأ ثاذهطصًنا .3

1 . :زطخنا 1.3

1 . زطاخًنا ةرادإ 2.3

VI . تيُعًنا فازطلأا 3.3

VII . زطخنا رذصي 4.3

2VII . ثذذنا 5.3

2VII . تبقاعنا 6.3

2 . تيناًتدلاا 3.3

2 . ظبإضنا 3.3

3 . :ادابًنا .4

4 . :يًيظُتنا راطلإا .5

4 . واع 1.5

5 . :وازتنلاا ٔ ةدايقنا 2.5

6 . جايذَلاا 3.5

3 .:ىيًصتنا 4.5

3 . آقايص ٔ ةأشًُنا ىٓف 1.4.5

3 . زطاخًنا ةرادئب وازتنلإا خيضٕت 2.4.5

3 . تيًيظُتنا ثلاءاضًنأ ، ثاينٔؤضًنأ ثاطهضنأ ،رأدلأا داُصا 3.4.5

3 . درإًنا صيصخت 4.4.5

9 . رٔاشتنا ٔ لاصتلاا 5.4.5

9 . :ذيفُتنا5.5

11 . ىييقتنا 6.5

11 . ٍيضذتنا 3.5

11 .ىهقأتنا 1.3.5

11 . زًتضًنا ٍيضذُنا 2.3.5

11 . :تيهًعنا .6

11 . واع 1.6

11 . رٔاشتنأ لاصتلاا 2.6

12 . زيياعًنأ قايضنا ،قاطُنا 3.6

12 . واع 1.3.6

12 . قاطُنا ذيذذت 2.3.6

13 . يهخاذنأ يجراخنا قايضنا 3.3.6

13 . زطخنا زيياعي فيزعت 4.3.6

14 . زطاخًنا ىييقت 4.6

14 . واع 1.4.6

14 . زطاخًنا ذيذذت 2.4.6

و

)ع( 02813:8222 زيا

15 . زطاخًنا ميهذت 3.4.6

16 . زطاخًنا زيذقت 4.4.6

16 . زطاخًنا تجناعي 5.6

16 . واع 1.5.6

13 . زطاخًنا تجناعي ثارايخ رايتخا 2.5.6

13 . زطاخًنا تجناعي ظطخ ذيفُتٔ داذعإ 3.5.6

13 . تعجازًنأ تبقازًنا 6.6

19 . )حاصفلإا( زيراقتنا عفرٔ ميجضتنا 3.6

21 . :عجازًنا

iii

و

)ع( 02813:8222 زيا

: ديهمت

ـلا يف ءاضعلأا تائييلا( ةينطولا سييقتلا تائييل يلود داحتا يى (ISO سييقتمل ةيلودلا ةمظنملا ( وزيلأا

ٌ

ةساردب ينعم وضع لكل .ISO لل ةينفلا ناجملا للاخ نم ةيلودلا ةيسايقلا تافصاوملا دادعإ متي ةداع .)ISO

تامظنملا لمعلا يف كلذك كراشيو .ضرغمل ةصتخملا ةينفلا ةنجملا كمت يف لاثمم نوكي نأ يف قحلا ةنيعم

عيمج يف ، )IEC( ةينقتورھكلا ةيلودلا ةنجملا عم قيثو لكشب وزيلاا نواعتت ،ةيموكحلا ريغو ةيموكحلاو ةيلودلا

. ينقتوريكلا سييقتلا رومأ

ISO / IEC تاييجوت يف ةحضوم اييمع ريوطتلا ةمصاومل كمتو ةفصاوملا هذى ريوطتل ةمدختسملا تاءرجلإاا

هذى ةغايص تمت .وزيلاا ىدل قئاثولا فمتخم زاجيلإ ةمزلالا ريبادتلا ريياعم اميس لا . لولأا ءزجلا ،

عجرا ( يناثلا ءزجلا ، ISO / IEC تاييجوتب ةصاخلا ريرحتلا دعاوقل اقفو ةقيثولا

ً

.)www.iso.org/directives

ةيلوؤسم وزيلاا لمحتت نل .ةيكمملا قوقح عوضوم ةقيثولا هذى رصانع ضعب نوكت نأ لامتحا ىلإ هابتنلاا ىجري

يف ةقيثولا ريوطت ءانثأ اىديدحت مت ةيكمممل قوقح ةيأ ليصافت .ايعيمج وأ هذى ةيكمملا قوقح نم يأ ديدحت

www.iso.org/patents).رظنا( ةممتسملا تاءربلاا تانلاعلإ وزيلاا ةمئاق يف وأ /و ةمدقملا

.ةقداصم لكشت لاو نيمدختسملا ىمع ريسيتمل ةمدقم تامومعم وى ةقيثولا هذى يف مدختسم يراجت مسا يأ

ةقمعتملا ةددحملا وزيلاا ترا يبعتو تاحمطصم ىنعمو ، ريياعممل ةيعوطلا ةعيبطلا لوح حرش ىمع لوصحمل

زجاوحلا يف (WTO) ةيملاعلا ةراجتلا ةمظنم ئدابمب وزيلاا مزتلاا لوح تامومعم ىلإ ةفاضلإاب ، ةقباطملا مييقتب

: www.iso.org/iso/foreword.html.يلاتلا URL ناونع رظنا ، (TBT)ةراجتلا مامأ ةينقتلا

.رطاخملا ةرادإ ، ISO / TC 262ةينفلا ةنجملا لبق نم ةقيثولا هذى دادعإ مت

. اينقت وتعجارم تمت يذلا )ISO 22293:9222( لولأا رادصلإا لحم لحيو يغمي يناثلا رادصلإا اذى

ً

:يمي امك يى قباسلا رادصلإاب ةنراقم ةيسيئرلا ترييا غتلا

.ايحاجنل ةيساسلأا ريياعملا يىو ، رطاخملا ةرادإ ئدابم ةعجارم

؛ ةأشنملا ةمكوح نم اءدب ، رطاخملا ةرادإ لماكتو ايمعلا ةرادلإا لبق نم ةدايقلا ىمع ءوضلا طيمست

ً

تلايمحتلاو فراعملاو تربخلاا نأ ةظحلام عم ، رطاخملا ةرادلإ ةيراركتلا ةعيبطلا ىمع زيكرتلا ةدايز

لحارم نم ةمحرم لك يف طباوضلاو تاءرجلإاا و ةيممعلا رصانع ةعجارم ىلإ يدؤت نأ نكمي ةديدجلا

؛ ةيممعلا

تاجايتحلاا مئلايل ةحوتفملا ةمظنلأا جذومن ةمادتسا ىمع ربكأ لكشب زيكرتلا عم ىوتحملا طيسبت

.ةددعتملا تاقايسلاو

iv

و

)ع( 02813:8222 زيا

:ةمدقملا

ةرادإ للاخ نم تآشنملا يف ةميقلا ةيامحو ءاشنإب نوموقي نيذلا صاخشلأا لبق نم مادختسلال ةقيثولا هذى تدعإ

.ءادلأا نيسحتو ايقيقحتو فادىلأا ديدحتو ، تراارقلا ذاختاو ، رطاخملا

.ايفادىأ نم ةدكأتم ريغ ايمعجت ةيمخادو ةيجراخ تريثا أتو لماوع ماجحلأاو عاونلأا عيمج نم تآشنملا وجاوت

فادىلأا قيقحتو ةيجيترتسلاا ا عضو يف تآشنملا دعاستو رمتسم وحن ىمع اىذيفنت متي ةيممع يى رطاخملا ةرادإ

.ةسوردم تراارق ذاختاو

بناج ىلإ .تايوتسملا عيمج ىمع ةسسؤملا ةرادلإ ةيساسأ يىو ، ةدايقلاو ةمكوحلا نم ءزج يى رطاخملا ةرادإ

.ةرادلإا ةمظنأ نيسحت يف مىاست اينأ

. ةينعملا فرطلأاا عم لعافتلا لمشتو ةسسؤملاب ةطبترملا ةطشنلأا عيمج نم اءزج رطاخملا ةرادإ دعت

ً

.ةيفاقثلا لماوعلاو يرشبلا كومسلا كلذ يف امب ، ةمظنممل يمخادلاو يجراخلا قايسلا رطاخملا ةرادإ سردت

يف حضوم وى امك ، ةقيثولا هذى يف ةحضوملا ةيممعلاو يميظنتلا راطلإا ،ئدابملا ىلإ رطاخملا ةرادإ دنتست

وأ ايفييكت ىلإ جاتحت دق ، كلذ عمو ، ةسسؤملا لخاد ايئزج وأ ايمك ةدوجوم تانوكملا هذى نوكت دقو .9 لكشلا

ً ً

.ةمءلامو ةيلاعفو ةءافكب رطاخملا ةرادإب مايقلا ىنستي ىتح اينيسحت

ةيممعلاو ، يميظنتلا راطلإاو ،ئدابملا – 0 لكشلا

v

و

)ع( 02813:8222 زيا

ةيهيجوتلا ةلدلأا - رطاخملا ةرادإ

:قاطنلا .1

هذى قيبطت ةمءاوم نكمي و .تآشنملا اييجاوت يتلا رطاخملا ةرادإ ةيممع لوح تاداشرإ ةقيثولا هذى رفوت

.ايقايسو ةأشنممل اقفو تاداشرلإا

.نيعم عاطق وأ ةنيعم ةعانصل ةيجوم تسيلو رطاخملا عاونأ نم عون يأ ةرادلإ ا كرتشم اجينم ةقيثولا هذى مدقت

ً

ً

رارقلا ةعانص كلذ يف امب طاشن يأ ىمع ايقيبطت نكميو ةسسؤملا ةايح ةرتف لاوط ةقيثولا هذى مادختسا نكمي

.تايوتسملا عيمج ىمع

:ةيسييقتلا عجارملا .2

.ةقيثولا هذى يف ةيسييقت عجارم يأ دجوت لا

:تافيرعتلاو تاحلطصملا .3

3ةيلاتلا تافيرعتلاو تاحمطصملا قبط ت ،ةقيثولا هذى ضرا غلأ

نيوانعلا ىمع سييقتلا يف ايمادختسلإ تاحمطصممل تانايب دعاوقب )IEC( يسييا و )ISO) وزيا ظفتحت

3ةيلاتلا

http://www.iso.org/obp ىمع ةحاتم 3تنرتنلإا ربع وزيا حفصت ةصنم -

http: //www.electelectedia.org ىمع ةحاتم 3IEC Electropedia -

:رطخلا 1.3

.فادهلاا قيقحت ىمع نيقيلالا ريثأت

جزَُ وأ كهخَ وأ جنبؼَ ٌأ ٍكًَو ، بًهُهك وأ ٍجهض وأ ٍثبجَإ ٌىكَ ٌأ ٍكًَ . غلىزًنا ٍػ فارحَا ىھ رُصأزنا )1( خظىحهي

.داذَذهرو صرف هُػ

.خفهزخي دبَىزطي ًهػ بهمُجطر ٍكًَو ، خفهزخي فبُصأو تَاىج فاذھلأن ٌىكَ ٌأ ٍكًَ )2( خظىحهي

بهجلاىػو ) 5.3 ( خهًزحًنا ساذحلأاو )4.3( رطخنا ردبصي شُح ٍي رطخنا ٍػ رُجؼزنا ىزَ حدبؼنا ٍف )3( خظىحهي

.) ٧.3( بهصوذح خُنبًزحاو )6.3(

رطاخملا ةرادإ 2.3

. )1.3( اْزطاخي يف ىكذتنأ ةأشًُنا ّيجٕتن تًظًُنا تطشَلأا ٍي تعًٕجي

ةينعملا فارطلأا 3.3

.اي طاشَ ٔأ رازقب زثأتي َّأ كر ذ ي ٔأ زثأتي ٔأ ز ثؤ ي ٌأ ٍكًي ةأشُي ٔأ صخش

و

)ع( 02813:8222 زيا

."خحهصًنا ةبحصأ" حهطصًن مَذجك "خُُؼًنا فرغلأا" حهطصي واذخزضا ٍكًَ : خظىحهي

رطخلا ردصم 4.3

. )1.3( زطاخي ذينٕتن تيَاكيإ ّيذن ٖزخأ زصاُع عي داذتلإاب ٔأ دزفُي زصُع

ثدحلا 5.3

. عئاقٕنا ٍي تُيعي تعًٕجي يف زييغت ٔأ تعقأ

. )6.3( تلاىػ حذػو ةبجضأ حذػ هن ٌىكَ ٌأ ٍكًَو ، رضكأ وأ حذحاو خؼلاو سذحنا ٌىكَ ٌأ ٍكًَ )1( خظىحهي

.ًبعَأ سذحَ غلىزي رُغ ئُش وأ ، سذحَ لا غلىزي ئُش ٍي سذحنا ٌىكزَ ٌأ ٍكًَ )2( خظىحهي

.رطخهن رذصي سذحنا ٌىكَ ٌأ ٍكًَ )3( خظىحهي

ةبقاعلا 6.3

. فاذْلأا ٗهع زثؤي ) 5.3( ثذد

...

INTERNATIONAL ISO

STANDARD 31000

Second edition

2018-02

Risk management — Guidelines

Management du risque — Lignes directrices

Reference number

©

ISO 2018

© ISO 2018

All rights reserved. Unless otherwise specified, or required in the context of its implementation, no part of this publication may

be reproduced or utilized otherwise in any form or by any means, electronic or mechanical, including photocopying, or posting

on the internet or an intranet, without prior written permission. Permission can be requested from either ISO at the address

below or ISO’s member body in the country of the requester.

ISO copyright office

CP 401 • Ch. de Blandonnet 8

CH-1214 Vernier, Geneva

Phone: +41 22 749 01 11

Fax: +41 22 749 09 47

Email: copyright@iso.org

Website: www.iso.org

Published in Switzerland

ii © ISO 2018 – All rights reserved

Contents Page

Foreword .iv

Introduction .v

1 Scope . 1

2 Normative references . 1

3 Terms and definitions . 1

4 Principles . 2

5 Framework . 4

5.1 General . 4

5.2 Leadership and commitment . 5

5.3 Integration . 5

5.4 Design . 6

5.4.1 Understanding the organization and its context . 6

5.4.2 Articulating risk management commitment . 6

5.4.3 Assigning organizational roles, authorities, responsibilities and accountabilities 7

5.4.4 Allocating resources. 7

5.4.5 Establishing communication and consultation . 7

5.5 Implementation . 7

5.6 Evaluation . 8

5.7 Improvement . 8

5.7.1 Adapting . 8

5.7.2 Continually improving . 8

6 Process . 8

6.1 General . 8

6.2 Communication and consultation . 9

6.3 Scope, context and criteria . .10

6.3.1 General.10

6.3.2 Defining the scope .10

6.3.3 External and internal context .10

6.3.4 Defining risk criteria.10

6.4 Risk assessment .11

6.4.1 General.11

6.4.2 Risk identification .11

6.4.3 Risk analysis .12

6.4.4 Risk evaluation .12

6.5 Risk treatment .13

6.5.1 General.13

6.5.2 Selection of risk treatment options .13

6.5.3 Preparing and implementing risk treatment plans .14

6.6 Monitoring and review .14

6.7 Recording and reporting .14

Bibliography .16

Foreword

ISO (the International Organization for Standardization) is a worldwide federation of national standards

bodies (ISO member bodies). The work of preparing International Standards is normally carried out

through ISO technical committees. Each member body interested in a subject for which a technical

committee has been established has the right to be represented on that committee. International

organizations, governmental and non-governmental, in liaison with ISO, also take part in the work.

ISO collaborates closely with the International Electrotechnical Commission (IEC) on all matters of

electrotechnical standardization.

The procedures used to develop this document and those intended for its further maintenance are

described in the ISO/IEC Directives, Part 1. In particular the different approval criteria needed for the

different types of ISO documents should be noted. This document was drafted in accordance with the

editorial rules of the ISO/IEC Directives, Part 2 (see www .iso .org/ directives).

Attention is drawn to the possibility that some of the elements of this document may be the subject of

patent rights. ISO shall not be held responsible for identifying any or all such patent rights. Details of

any patent rights identified during the development of the document will be in the Introduction and/or

on the ISO list of patent declarations received (see www .iso .org/ patents).

Any trade name used in this document is information given for the convenience of users and does not

constitute an endorsement.

For an explanation on the voluntary nature of standards, the meaning of ISO specific terms and

expressions related to conformity assessment, as well as information about ISO’s adherence to the

World Trade Organization (WTO) principles in the Technical Barriers to Trade (TBT) see the following

URL: www .iso .org/ iso/ foreword .html.

This document was prepared by Technical Committee ISO/TC 262, Risk management.

This second edition cancels and replaces the first edition (ISO 31000:2009) which has been technically

revised.

The main changes compared to the previous edition are as follows:

— review of the principles of risk management, which are the key criteria for its success;

— highlighting of the leadership by top management and the integration of risk management, starting

with the governance of the organization;

— greater emphasis on the iterative nature of risk management, noting that new experiences,

knowledge and analysis can lead to a revision of process elements, actions and controls at each

stage of the process;

— streamlining of the content with greater focus on sustaining an open systems model to fit multiple

needs and contexts.

iv © ISO 2018 – All rights reserved

Introduction

This document is for use by people who create and protect value in organizations by managing risks,

making decisions, setting and achieving objectives and improving performance.

Organizations of all types and sizes face external and internal factors and influences that make it

uncertain whether they will achieve their objectives.

Managing risk is iterative and assists organizations in setting strategy, achieving objectives and making

informed decisions.

Managing risk is part of governance and leadership, and is fundamental to how the organization is

managed at all levels. It contributes to the improvement of management systems.

Managing risk is part of all activities associated with an organization and includes interaction with

stakeholders.

Managing risk considers the external and internal context of the organization, including human

behaviour and cultural factors.

Managing risk is based on the principles, framework and process outlined in this document, as

illustrated in Figure 1. These components might already exist in full or in part within the organization,

however, they might need to be adapted or improved so that managing risk is efficient, effective and

consistent.

d

Figure 1 — Principles, framework and process

INTERNATIONAL STANDARD ISO 31000:2018(E)

Risk management — Guidelines

1 Scope

This document provides guidelines on managing risk faced by organizations. The application of these

guidelines can be customized to any organization and its context.

This document provides a common approach to managing any type of risk and is not industry or sector

specific.

This document can be used throughout the life of the organization and can be applied to any activity,

including decision-making at all levels.

2 Normative references

There are no normative references in this document.

3 Terms and definitions

For the purposes of this document, the following terms and definitions apply.

ISO and IEC maintain terminological databases for use in standardization at the following addresses:

— ISO Online browsing platform: available at http:// www .iso .org/ obp

— IEC Electropedia: available at http:// www .electropedia .org

3.1

risk

effect of uncertainty on objectives

Note 1 to entry: An effect is a deviation from the expected. It can be positive, negative or both, and can address,

create or result in opportunities and threats.

Note 2 to entry: Objectives can have different aspects and categories, and can be applied at different levels.

Note 3 to entry: Risk is usually expressed in terms of risk sources (3.4), potential events (3.5), their consequences

(3.6) and their likelihood (3.7).

3.2

risk management

coordinated activities to direct and control an organization with regard to risk (3.1)

3.3

stakeholder

person or organization that can affect, be affected by, or perceive themselves to be affected by a decision

or activity

Note 1 to entry: The term “interested party” can be used as an alternative to “stakeholder”.

3.4

risk source

element which a

...

INTERNATIONAL ISO

STANDARD 31000

Redline version

compares Second edition to

First edition

Risk management — Guidelines

Management du risque — Lignes directrices

Reference number

ISO 31000:redline:2018(E)

©

ISO 2018

ISO 31000:redline:2018(E)

IMPORTANT — PLEASE NOTE

This is a mark-up copy and uses the following colour coding:

Text example 1 — indicates added text (in green)

Text example 2 — indicates removed text (in red)

— indicates added graphic figure

— indicates removed graphic figure

1.x . — Heading numbers containg modifications are highlighted in yellow in

the Table of Contents

DISCLAIMER

This Redline version provides you with a quick and easy way to compare the main changes

between this edition of the standard and its previous edition. It doesn’t capture all single

changes such as punctuation but highlights the modifications providing customers with

the most valuable information. Therefore it is important to note that this Redline version is

not the official ISO standard and that the users must consult with the clean version of the

standard, which is the official standard, for implementation purposes.

© ISO 2018

All rights reserved. Unless otherwise specified, or required in the context of its implementation, no part of this publication may

be reproduced or utilized otherwise in any form or by any means, electronic or mechanical, including photocopying, or posting

on the internet or an intranet, without prior written permission. Permission can be requested from either ISO at the address

below or ISO’s member body in the country of the requester.

ISO copyright office

CP 401 • Ch. de Blandonnet 8

CH-1214 Vernier, Geneva

Phone: +41 22 749 01 11

Fax: +41 22 749 09 47

Email: copyright@iso.org

Website: www.iso.org

Published in Switzerland

ii © ISO 2018 – All rights reserved

ISO 31000:redline:2018(E)

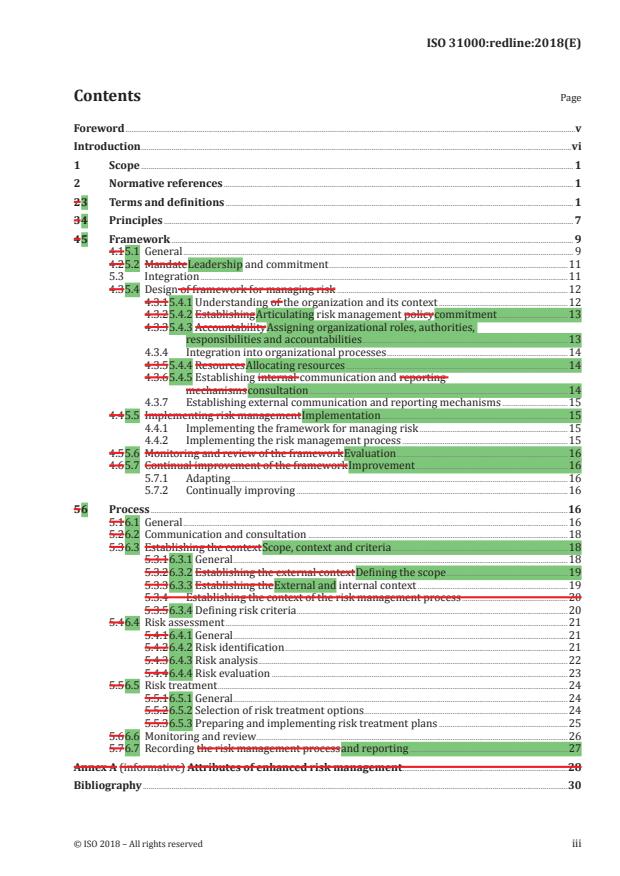

Contents Page

Foreword .v

Introduction .vi

1 Scope . 1

2 Normative references . 1

2 3 Terms and definitions . 1

3 4 Principles . 7

4 5 Framework . 9

4.1 5.1 General . 9

4.2 5.2 Mandate Leadership and commitment .11

5.3 Integration .11

4.3 5.4 Design of framework for managing risk .12

4.3.1 5.4.1 Understanding of the organization and its context .12

4.3.2 5.4.2 Establishing Articulating risk management policy commitment .13

4.3.3 5.4.3 Accountability Assigning organizational roles, authorities,

responsibilities and accountabilities .13

4.3.4 Integration into organizational processes .14

4.3.5 5.4.4 Resources Allocating resources .14

4.3.6 5.4.5 Establishing internal communication and reporting

mechanisms consultation .14

4.3.7 Establishing external communication and reporting mechanisms .15

4.4 5.5 Implementing risk management Implementation .15

4.4.1 Implementing the framework for managing risk .15

4.4.2 Implementing the risk management process .15

4.5 5.6 Monitoring and review of the framework Evaluation .16

4.6 5.7 Continual improvement of the framework Improvement .16

5.7.1 Adapting .16

5.7.2 Continually improving .16

5 6 Process .16

5.1 6.1 General .16

5.2 6.2 Communication and consultation .18

5.3 6.3 Establishing the context Scope, context and criteria .18

5.3.1 6.3.1 General .18

5.3.2 6.3.2 Establishing the external context Defining the scope .19

5.3.3 6.3.3 Establishing the External and internal context .19

5.3.4 Establishing the context of the risk management process .20

5.3.5 6.3.4 Defining risk criteria .20

5.4 6.4 Risk assessment .21

5.4.1 6.4.1 General .21

5.4.2 6.4.2 Risk identification .21

5.4.3 6.4.3 Risk analysis .22

5.4.4 6.4.4 Risk evaluation .23

5.5 6.5 Risk treatment .24

5.5.1 6.5.1 General .24

5.5.2 6.5.2 Selection of risk treatment options.24

5.5.3 6.5.3 Preparing and implementing risk treatment plans .25

5.6 6.6 Monitoring and review .26

5.7 6.7 Recording the risk management process and reporting .27

Annex A (informative) Attributes of enhanced risk management .28

Bibliography .30

ISO 31000:redline:2018(E)

iv © ISO 2018 – All rights reserved

ISO 31000:redline:2018(E)

Foreword

ISO (the International Organization for Standardization) is a worldwide federation of national standards

bodies (ISO member bodies). The work of preparing International Standards is normally carried out

through ISO technical committees. Each member body interested in a subject for which a technical

committee has been established has the right to be represented on that committee. International

organizations, governmental and non-governmental, in liaison with ISO, also take part in the work.

ISO collaborates closely with the International Electrotechnical Commission (IEC) on all matters of

electrotechnical standardization.

International Standards areThe procedures used to develop this document and those intended for

its further maintenance are described in the ISO/IEC Directives, Part 1. In particular the different

approval criteria needed for the different types of ISO documents should be noted. This document was

drafted in accordance with the rules given ineditorial rules of the ISO/IEC Directives, Part 2 (see www

.iso .org/ directives).

The main task of technical committees is to prepare International Standards. Draft International

Standards adopted by the technical committees are circulated to the member bodies for voting.

Publication as an International Standard requires approval by at least 75 % of the member bodies

casting a vote.

Attention is drawn to the possibility that some of the elements of this document may be the subject of

patent rights. ISO shall not be held responsible for identifying any or all such patent rights. Details of

any patent rights identified during the development of the document will be in the Introduction and/or

on the ISO list of patent declarations received (see www .iso .org/ patents).

Any trade name used in this document is information given for the convenience of users and does not

constitute an endorsement.

For an explanation on the voluntary nature of standards, the meaning of ISO specific terms and

expressions related to conformity assessment, as well as information about ISO’s adherence to the

World Trade Organization (WTO) principles in the Technical Barriers to Trade (TBT) see the following

URL: www .iso .org/ iso/ foreword .html.

ISO 31000This document was prepared by the ISO Technical Management Board Working Group on

riskTechnical Committee ISO/TC 262, Risk management.

This second edition cancels and replaces the first edition (ISO 31000:2009) which has been technically

revised.

The main changes compared to the previous edition are as follows:

— review of the principles of risk management, which are the key criteria for its success;

— highlighting of the leadership by top management and the integration of risk management, starting

with the governance of the organization;

— greater emphasis on the iterative nature of risk management, noting that new experiences,

knowledge and analysis can lead to a revision of process elements, actions and controls at each

stage of the process;

— streamlining of the content with greater focus on sustaining an open systems model to fit multiple

needs and contexts.

ISO 31000:redline:2018(E)

Introduction

This document is for use by people who create and protect value in organizations by managing risks,

making decisions, setting and achieving objectives and improving performance.

Organizations of all types and sizes face internal and externalexternal and internal factors and

influences that make it uncertain whether and when they will achieve their objectives. The effect this

uncertainty has on an organization's objectives is “risk”.

All activities of an organization involve risk. Organizations manage risk by identifying it, analysing

it and then evaluating whether the risk should be modified by risk treatment in order to satisfy their

risk criteria. Throughout this process, they communicate and consult with stakeholders and monitor

and review the risk and the controls that are modifying the risk in order to ensure that no further risk

treatment is required. This International Standard describes this systematic and logical process in detail.

While all organizations manage risk

...

NORME ISO

INTERNATIONALE 31000

Deuxième édition

2018-02

Management du risque — Lignes

directrices

Risk management — Guidelines

Numéro de référence

©

ISO 2018

DOCUMENT PROTÉGÉ PAR COPYRIGHT

© ISO 2018

Tous droits réservés. Sauf prescription différente ou nécessité dans le contexte de sa mise en oeuvre, aucune partie de cette

publication ne peut être reproduite ni utilisée sous quelque forme que ce soit et par aucun procédé, électronique ou mécanique,

y compris la photocopie, ou la diffusion sur l’internet ou sur un intranet, sans autorisation écrite préalable. Une autorisation peut

être demandée à l’ISO à l’adresse ci-après ou au comité membre de l’ISO dans le pays du demandeur.

ISO copyright office

Case postale 401 • Ch. de Blandonnet 8

CH-1214 Vernier, Geneva

Tél.: +41 22 749 01 11

Fax: +41 22 749 09 47

E-mail: copyright@iso.org

Web: www.iso.org

Publié en Suisse

ii © ISO 2018 – Tous droits réservés

Sommaire Page

Avant-propos .iv

Introduction .v

1 Domaine d’application . 1

2 Références normatives . 1

3 Termes et définitions . 1

4 Principes . 2

5 Cadre organisationnel . 4

5.1 Généralités . 4

5.2 Leadership et engagement. 5

5.3 Intégration . 5

5.4 Conception . 6

5.4.1 Compréhension de l’organisme et de son contexte . 6

5.4.2 Définir clairement l’engagement en matière de management du risque. 6

5.4.3 Attribution des rôles, pouvoirs et responsabilités au sein de l’organisme . 7

5.4.4 Affectation des ressources . 7

5.4.5 Établissement d’une communication et d’une concertation . 7

5.5 Mise en œuvre. 8

5.6 Évaluation . 8

5.7 Amélioration . 8

5.7.1 Adaptation . 8

5.7.2 Amélioration continue . 8

6 Processus . 8

6.1 Généralités . 8

6.2 Communication et consultation . 9

6.3 Périmètre d’application, contexte et critères . .10

6.3.1 Généralités .10

6.3.2 Définition du domaine d’application .10

6.3.3 Contexte interne et externe .10

6.3.4 Définition des critères de risque .11

6.4 Appréciation du risque .11

6.4.1 Généralités .11

6.4.2 Identification du risque.11

6.4.3 Analyse du risque .12

6.4.4 Évaluation du risque .13

6.5 Traitement du risque .13

6.5.1 Généralités .13

6.5.2 Sélection des options de traitement du risque .13

6.5.3 Élaboration et mise en œuvre des plans de traitement du risque .14

6.6 Suivi et revue .14

6.7 Enregistrement et élaboration de rapports .15

Bibliographie .16

Avant-propos

L’ISO (Organisation internationale de normalisation) est une fédération mondiale d’organismes

nationaux de normalisation (comités membres de l’ISO). L’élaboration des Normes internationales est

en général confiée aux comités techniques de l’ISO. Chaque comité membre intéressé par une étude

a le droit de faire partie du comité technique créé à cet effet. Les organisations internationales,

gouvernementales et non gouvernementales, en liaison avec l’ISO participent également aux travaux.

L’ISO collabore étroitement avec la Commission électrotechnique internationale (IEC) en ce qui

concerne la normalisation électrotechnique.

Les procédures utilisées pour élaborer le présent document et celles destinées à sa mise à jour sont

décrites dans les Directives ISO/IEC, Partie 1. Il convient, en particulier de prendre note des différents

critères d’approbation requis pour les différents types de documents ISO. Le présent document a été

rédigé conformément aux règles de rédaction données dans les Directives ISO/IEC, Partie 2 (voir www

.iso .org/ directives).

L’attention est attirée sur le fait que certains des éléments du présent document peuvent faire l’objet de

droits de propriété intellectuelle ou de droits analogues. L’ISO ne saurait être tenue pour responsable

de ne pas avoir identifié de tels droits de propriété et averti de leur existence. Les détails concernant

les références aux droits de propriété intellectuelle ou autres droits analogues identifiés lors de

l’élaboration du document sont indiqués dans l’Introduction et/ou dans la liste des déclarations de

brevets reçues par l’ISO (voir www .iso .org/ brevets).

Les appellations commerciales éventuellement mentionnées dans le présent document sont données

pour information, par souci de commodité, à l’intention des utilisateurs et ne sauraient constituer un

engagement.

Pour une explication de la nature volontaire des normes, la signification des termes et expressions

spécifiques de l’ISO liés à l’évaluation de la conformité, ou pour toute information au sujet de l’adhésion

de l’ISO aux principes de l’Organisation mondiale du commerce (OMC) concernant les obstacles

techniques au commerce (OTC), voir le lien suivant: www .iso .org/ avant -propos.

Le présent document a été élaboré par le comité technique ISO/TC 262, Management du risque.

Cette deuxième édition annule et remplace la première édition (ISO 31000:2009), qui a fait l’objet d’une

révision technique.

Les principales modifications par rapport à l’édition précédente sont les suivantes:

— revue des principes de management du risque, qui sont les critères clés de sa réussite;

— mise en exergue du leadership de la direction et de l’intégration du management du risque, en

commençant par la gouvernance de l’organisme;

— importance accrue accordée à la nature itérative du management du risque, en notant que de

nouvelles expériences, connaissances et analyses peuvent conduire à une révision des éléments,

actions et moyens de maîtrise du processus à chacune de ses étapes;

— simplification du contenu en se concentrant davantage sur le maintien d’un modèle de système

ouvert pour s’adapter à de multiples besoins et contextes.

iv © ISO 2018 – Tous droits réservés

Introduction

Le présent document s’adresse aux personnes qui, au sein des organismes, créent de la valeur et la

préservent par le management du risque, la prise de décisions, la définition et l’atteinte d’objectifs et

l’amélioration de la performance.

Les organismes de tous types et de toutes tailles sont confrontés à des facteurs et des influences

internes et externes qui rendent l’atteinte de leurs objectifs incertaine.

Le management du risque est une activité itérative qui aide les organismes à développer une stratégie,

atteindre des objectifs et prendre des décisions éclairées.

Le management du risque fait partie intégrante de la gouvernance et du leadership et a une importance

fondamentale dans la façon dont l’organisme est géré à tous les niveaux. Il contribue à l’amélioration des

systèmes de management.

Le management du risque est intégré à toutes les activités d’un organisme et inclut l’interaction avec les

parties prenantes.

Le management du risque prend en considération le contexte interne et externe de l’organisme, y

compris le comportement humain et les facteurs culturels.

Le management du risque est fondé sur les principes, le cadre organisationnel et le processus décrits

dans le présent document, tel qu’illustré à la Figure 1. Ces éléments peuvent déjà exister, en totalité ou

en partie, au sein de l’organisme; toutefois, ils peuvent nécessiter une adaptation ou une amélioration

afin que le management du risque soit efficient, efficace et cohérent.

Figure 1 — Principes, cadre organisationnel et processus

NORME INTERNATIONALE ISO 31000:2018(F)

Management du risque — Lignes directrices

1 Domaine d’application

Le présent document fournit des lignes directrices concernant le management du risque auquel sont

confrontés les organismes. L’application de ces lignes directrices peut être adaptée à tout organisme et

à son contexte.

Le présent document fournit une approche générique permettant de gérer toute forme de risque et n’est

pas spécifique à une industrie ou un secteur.

Le présent document peut être utilisé tout au long de la vie de l’organisme et peut être appliqué à toute

activité, y compris la prise de décisions à tous les niveaux.

2 Références normatives

Le présent document ne contient aucune référence normative.

3 Termes et définitions

Pour les besoins du présent document, les termes et définitions suivants s’appliquent.

L’ISO et l’IEC tiennent à jour des bases de données terminologiques destinées à être utilisées en

normalisation, consultables aux adresses suivantes:

— ISO Online browsing platform: disponible à l’adresse https:// www .iso .org/ obp

— IEC Electropedia: disponible à l’adresse https:// www .electropedia .org/

3.1

risque

effet de l’incertitude sur les objectifs

Note 1 à l'artic

...

NORME ISO

INTERNATIONALE 31000

Redline version

compare la Deuxième édition

à la Première édition

Management du risque — Lignes

directrices

Risk management — Guidelines

Numéro de référence

ISO 31000:redline:2018(F)

©

ISO 2018

ISO 31000:redline:2018(F)

IMPORTANT — PLEASE NOTE

This is a mark-up copy and uses the following colour coding:

Text example 1 — indicates added text (in green)

Text example 2 — indicates removed text (in red)

— indicates added graphic figure

— indicates removed graphic figure

1.x . — Heading numbers containg modifications are highlighted in yellow in

the Table of Contents

DISCLAIMER

This Redline version provides you with a quick and easy way to compare the main changes

between this edition of the standard and its previous edition. It doesn’t capture all single

changes such as punctuation but highlights the modifications providing customers with

the most valuable information. Therefore it is important to note that this Redline version is

not the official ISO standard and that the users must consult with the clean version of the

standard, which is the official standard, for implementation purposes.

DOCUMENT PROTÉGÉ PAR COPYRIGHT

© ISO 2018

Tous droits réservés. Sauf prescription différente ou nécessité dans le contexte de sa mise en oeuvre, aucune partie de cette

publication ne peut être reproduite ni utilisée sous quelque forme que ce soit et par aucun procédé, électronique ou mécanique,

y compris la photocopie, ou la diffusion sur l’internet ou sur un intranet, sans autorisation écrite préalable. Une autorisation peut

être demandée à l’ISO à l’adresse ci-après ou au comité membre de l’ISO dans le pays du demandeur.

ISO copyright office

Case postale 401 • Ch. de Blandonnet 8

CH-1214 Vernier, Geneva

Tél.: +41 22 749 01 11

Fax: +41 22 749 09 47

E-mail: copyright@iso.org

Web: www.iso.org

Publié en Suisse

ii © ISO 2018 – Tous droits réservés

ISO 31000:redline:2018(F)

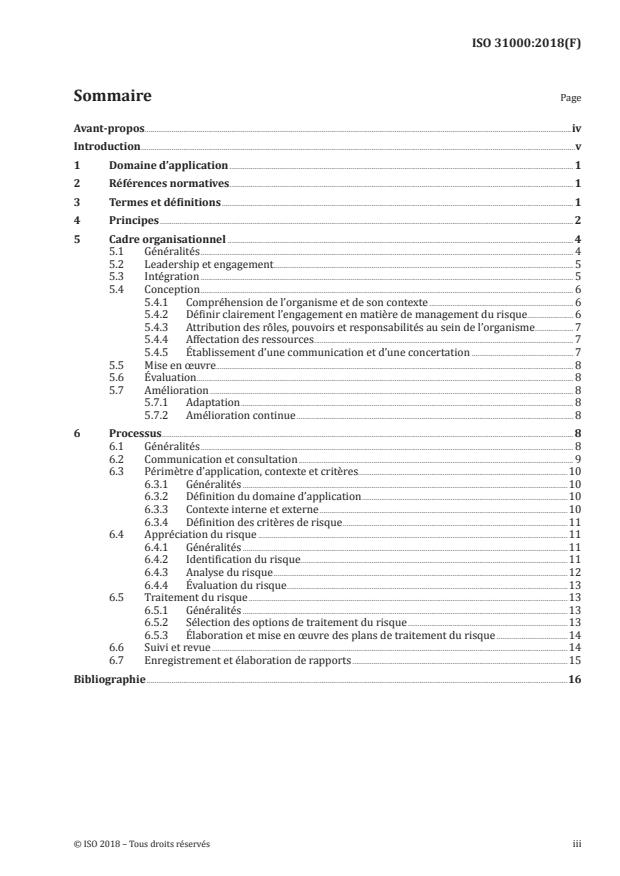

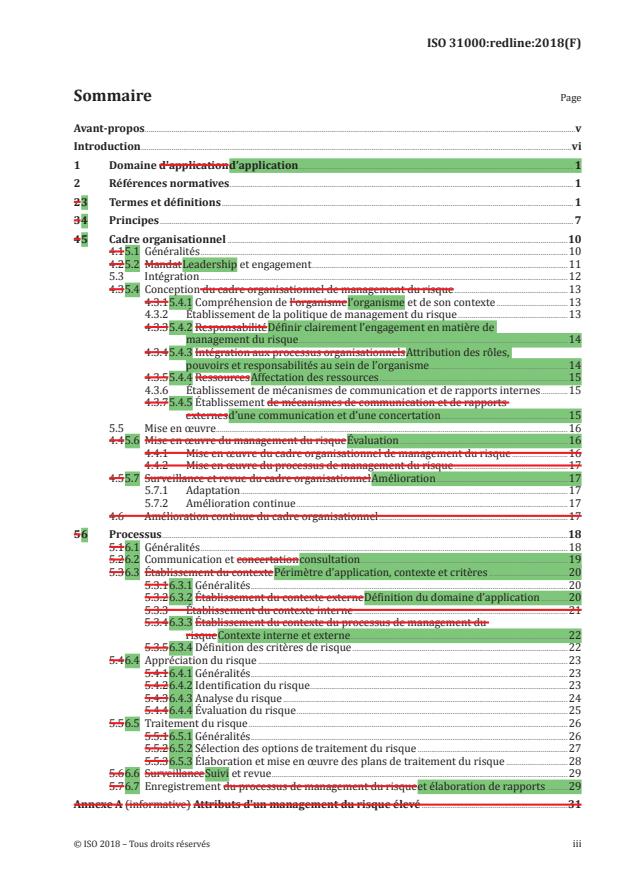

Sommaire Page

Avant-propos .v

Introduction .vi

1 Domaine d'application d’application . 1

2 Références normatives . 1

2 3 Termes et définitions . 1

3 4 Principes . 7

4 5 Cadre organisationnel .10

4.1 5.1 Généralités .10

4.2 5.2 Mandat Leadership et engagement .11

5.3 Intégration .12

4.3 5.4 Conception du cadre organisationnel de management du risque .13

4.3.1 5.4.1 Compréhension de l'organisme l’organisme et de son contexte .13

4.3.2 Établissement de la politique de management du risque .13

4.3.3 5.4.2 Responsabilité Définir clairement l’engagement en matière de

management du risque .14

4.3.4 5.4.3 Intégration aux processus organisationnels Attribution des rôles,

pouvoirs et responsabilités au sein de l’organisme .14

4.3.5 5.4.4 Ressources Affectation des ressources .15

4.3.6 Établissement de mécanismes de communication et de rapports internes .15

4.3.7 5.4.5 Établissement de mécanismes de communication et de rapports

externes d’une communication et d’une concertation .15

5.5 Mise en œuvre.16

4.4 5.6 Mise en œuvre du management du risque Évaluation .16

4.4.1 Mise en œuvre du cadre organisationnel de management du risque .16

4.4.2 Mise en œuvre du processus de management du risque .17

4.5 5.7 Surveillance et revue du cadre organisationnel Amélioration .17

5.7.1 Adaptation .17

5.7.2 Amélioration continue .17

4.6 Amélioration continue du cadre organisationnel .17

5 6 Processus .18

5.1 6.1 Généralités .18

5.2 6.2 Communication et concertation consultation.19

5.3 6.3 Établissement du contexte Périmètre d’application, contexte et critères .20

5.3.1 6.3.1 Généralités .20

5.3.2 6.3.2 Établissement du contexte externe Définition du domaine d’application .20

5.3.3 Établissement du contexte interne .21

5.3.4 6.3.3 Établissement du contexte du processus de management du

risque Contexte interne et externe .22

5.3.5 6.3.4 Définition des critères de risque .22

5.4 6.4 Appréciation du risque .23

5.4.1 6.4.1 Généralités .23

5.4.2 6.4.2 Identification du risque .23

5.4.3 6.4.3 Analyse du risque .24

5.4.4 6.4.4 Évaluation du risque .25

5.5 6.5 Traitement du risque .26

5.5.1 6.5.1 Généralités .26

5.5.2 6.5.2 Sélection des options de traitement du risque .27

5.5.3 6.5.3 Élaboration et mise en œuvre des plans de traitement du risque .28

5.6 6.6 Surveillance Suivi et revue .29

5.7 6.7 Enregistrement du processus de management du risque et élaboration de rapports .29

Annexe A (informative) Attributs d'un management du risque élevé .31

ISO 31000:redline:2018(F)

Bibliographie .33

iv © ISO 2018 – Tous droits réservés

ISO 31000:redline:2018(F)

Avant-propos

L'ISOL’ISO (Organisation internationale de normalisation) est une fédération mondiale

d'organismesd’organismes nationaux de normalisation (comités membres de l'ISOl’ISO).

L'élaborationL’élaboration des Normes internationales est en général confiée aux comités techniques de

l'ISOl’ISO. Chaque comité membre intéressé par une étude a le droit de faire partie du comité technique

créé à cet effet. Les organisations internationales, gouvernementales et non gouvernementales, en liaison

avec l'ISOl’ISO participent également aux travaux. L'ISOL’ISO collabore étroitement avec la Commission

électrotechnique internationale (CEIIEC) en ce qui concerne la normalisation électrotechnique.

Les Normes internationales sont rédigéesprocédures utilisées pour élaborer le présent document

et celles destinées à sa mise à jour sont décrites dans les Directives ISO/IEC, Partie 1. Il convient, en

particulier de prendre note des différents critères d’approbation requis pour les différents types de

documents ISO. Le présent document a été rédigé conformément aux règles de rédaction données dans

les Directives ISO/CEIIEC, Partie 2 (voir www .iso .org/ directives).

La tâche principale des comités techniques est d'élaborer les Normes internationales. Les projets de

Normes internationales adoptés par les comités techniques sont soumis aux comités membres pour

vote. Leur publication comme Normes internationales requiert l'approbation de 75 % au moins des

comités membres votants.

L'attention est appeléeL’attention est attirée sur le fait que certains des éléments du présent document

peuvent faire l'objetl’objet de droits de propriété intellectuelle ou de droits analogues. L'ISOL’ISO ne

saurait être tenue pour responsable de ne pas avoir identifié de tels droits de propriété et averti de leur

existence. Les détails concernant les références aux droits de propriété intellectuelle ou autres droits

analogues identifiés lors de l’élaboration du document sont indiqués dans l’Introduction et/ou dans la

liste des déclarations de brevets reçues par l’ISO (voir www .iso .org/ brevets).

Les appellations commerciales éventuellement mentionnées dans le présent document sont données

pour information, par souci de commodité, à l’intention des utilisateurs et ne sauraient constituer un

engagement.

Pour une explication de la nature volontaire des normes, la signification des termes et expressions

spécifiques de l’ISO liés à l’évaluation de la conformité, ou pour toute information au sujet de l’adhésion

de l’ISO aux principes de l’Organisation mondiale du commerce (OMC) concernant les obstacles

techniques au commerce (OTC), voir le lien suivant: www .iso .org/ avant -propos.

L'ISO 31000Le présent document a été élaborée par le groupe de travail du Bureau de gestion technique

ISOélaboré par le comité technique ISO/TC 262, sur le Management du risque.

Cette deuxième édition annule et remplace la première édition (ISO 31000:2009), qui a fait l’objet d’une

révision technique.

Les principales modifications par rapport à l’édition précédente sont les suivantes:

— revue des principes de management du risque, qui sont les critères clés de sa réussite;

— mise en exergue du leadership de la direction et de l’intégration du management du risque, en

commençant par la gouvernance de l’organisme;

— importance accrue accordée à la nature itérative du management du risque, en notant que de

nouvelles expériences, connaissances et analyses peuvent conduire à une révision des éléments,

actions et moyens de maîtrise du processus à chacune de ses étapes;

— simplification du contenu en se concentrant davantage sur le maintien d’un modèle de système

ouvert pour s’adapter à de multiples besoins et contextes.

ISO 31000:redline:2018(F)

Introduction

Le présent document s’adresse aux personnes qui, au sein des organismes, créent de la valeur et la

préservent par le management du risque, la prise de décisions, la définition et l’atteinte d’objectifs et

l’amélioration de la performance.

Les organismes de tous types et de toutes dimensionstailles sont confrontés à des facteurs et des

influences internes et externes ignorent si et quand ils vont atteindre leurs objecti

...

NORMA ISO

INTERNACIONAL 31000

Traducción oficial

Segunda edición

Official translation

2018-02

Traduction officielle

Gestión del riesgo — Directrices

Risk management — Guidelines

Management du risque — Lignes directrices

Publicado por la Secretaría Central de ISO en Ginebra, Suiza, como

traducción oficial en español avalada por el Translation

Management Group, que ha certificado la conformidad en relación

con las versiones inglesa y francesa.

Número de referencia

(traducción oficial)

©

ISO 2018

DOCUMENTO PROTEGIDO POR COPYRIGHT

© ISO 2018. Publicado en Suiza

Reservados los derechos de reproducción. Salvo prescripción diferente, o requerido en el contexto de su implementación, no

podrá reproducirse ni utilizarse ninguna parte de esta publicación bajo ninguna forma y por ningún medio, electrónico o

mecánico, incluidos el fotocopiado, o la publicación en Internet o una Intranet, sin la autorización previa por escrito. La

autorización puede solicitarse a ISO en la siguiente dirección o al organismo miembro de ISO en el país solicitante.

ISO copyright office

Ch. de Blandonnet 8 CP 401

CH-1214 Vernier, Ginebra, Suiza

Tel. + 41 22 749 01 11

Fax + 41 22 749 09 47

E-mail copyright@iso.org

Web www.iso.org

Versión española publicada en 2018

Traducción oficial/Official translation/Traduction officielle

ii © ISO 2018 — Todos los derechos reservados

Índice Página

Prólogo . iv

Prólogo de la versión en español . v

Introducción . vi

1 Objeto y campo de aplicación .1

2 Referencias normativas.1

3 Términos y definiciones .1

4 Principios .3

5 Marco de referencia .4

5.1 Generalidades . 4

5.2 Liderazgo y compromiso . 5

5.3 Integración . 6

5.4 Diseño . 6

5.4.1 Comprensión de la organización y de su contexto . 6

5.4.2 Articulación del compromiso con la gestión del riesgo . 7

5.4.3 Asignación de roles, autoridades, responsabilidades y obligación de rendir

cuentas en la organización . 8

5.4.4 Asignación de recursos . 8

5.4.5 Establecimiento de la comunicación y la consulta . 8

5.5 Implementación . 9

5.6 Valoración . 9

5.7 Mejora . 9

5.7.1 Adaptación . 9

5.7.2 Mejora continua . 9

6 Proceso . 10

6.1 Generalidades . 10

6.2 Comunicación y consulta . 11

6.3 Alcance, contexto y criterios . 11

6.3.1 Generalidades . 11

6.3.2 Definición del alcance . 11

6.3.3 Contextos externo e interno . 12

6.3.4 Definición de los criterios del riesgo . 12

6.4 Evaluación del riesgo . 13

6.4.1 Generalidades . 13

6.4.2 Identificación del riesgo . 13

6.4.3 Análisis del riesgo . 13

6.4.4 Valoración del riesgo . 14

6.5 Tratamiento del riesgo . 15

6.5.1 Generalidades . 15

6.5.2 Selección de las opciones para el tratamiento del riesgo . 15

6.5.3 Preparación e implementación de los planes de tratamiento del riesgo . 16

6.6 Seguimiento y revisión . 16

6.7 Registro e informe . 17

Bibliografía . 18

Traducción oficial/Official translation/Traduction officielle

Prólogo

ISO (Organización Internacional de Normalización) es una federación mundial de organismos

nacionales de normalización (organismos miembros de ISO). El trabajo de preparación de las Normas

Internacionales normalmente se realiza a través de los comités técnicos de ISO. Cada organismo

miembro interesado en una materia para la cual se haya establecido un comité técnico, tiene el derecho

de estar representado en dicho comité. Las organizaciones internacionales, públicas y privadas, en

coordinación con ISO, también participan en el trabajo. ISO colabora estrechamente con la Comisión

Electrotécnica Internacional (IEC) en todas las materias de normalización electrotécnica.

En la Parte 1 de las Directivas ISO/IEC se describen los procedimientos utilizados para desarrollar este

documento y para su mantenimiento posterior. En particular debería tomarse nota de los diferentes

criterios de aprobación necesarios para los distintos tipos de documentos ISO. Este documento se redactó

de acuerdo a las reglas editoriales de la Parte 2 de las Directivas ISO/IEC. www.iso.org/directives.

Se llama la atención sobre la posibilidad de que algunos de los elementos de este documento puedan

estar sujetos a derechos de patente. ISO no asume la responsabilidad por la identificación de cualquiera

o todos los derechos de patente. Los detalles sobre cualquier derecho de patente identificado durante el

desarrollo de este documento se indican en la introducción y/o en la lista ISO de declaraciones de

patente recibidas. www.iso.org/patents.

Cualquier nombre comercial utilizado en este documento es información que se proporciona para

comodidad del usuario y no constituye una recomendación.

Para obtener una explicación sobre el significado de los términos específicos de ISO y expresiones

relacionadas con la evaluación de la conformidad, así como información de la adhesión de ISO a los

principios de la Organización Mundial del Comercio (OMC) respecto a los Obstáculos Técnicos al

Comercio (OTC), véase la siguiente dirección: www.iso.org/iso/foreword.html.

El comité responsable de este documento es el ISO/TC 262, Gestión del riesgo.

Esta segunda edición anula y sustituye a la primera edición (ISO 31000:2009) que ha sido revisada

técnicamente.

Los principales cambios en comparación con la edición anterior son los siguientes:

— se revisan los principios de la gestión del riesgo, que son los criterios clave para su éxito;

— se destaca el liderazgo de la alta dirección y la integración de la gestión del riesgo, comenzando con

la gobernanza de la organización;

— se pone mayor énfasis en la naturaleza iterativa de la gestión del riesgo, señalando que las nuevas

experiencias, el conocimiento y el análisis pueden llevar a una revisión de los elementos del

proceso, las acciones y los controles en cada etapa del proceso;

— se simplifica el contenido con un mayor enfoque en mantener un modelo de sistemas abiertos para

adaptarse a múltiples necesidades y contextos.

Traducción oficial/Official translation/Traduction officielle

iv © ISO 2018 — Todos los derechos reservados

Prólogo de la versión en español

Este documento ha sido traducido por el Grupo de Trabajo Spanish Translation Task Force (STTF) del

Comité Técnico ISO/TC 262, Gestión del riesgo, en el que participan representantes de los organismos

nacionales de normalización y representantes del sector empresarial de los siguientes países:

Argentina, Chile, Colombia, Costa Rica, Ecuador, El Salvador, España, México, Panamá, Perú, y Uruguay.

Igualmente, en el citado Grupo de Trabajo participan representantes de COPANT (Comisión

Panamericana de Normas Técnicas) e INLAC (Instituto Latinoamericano de la Calidad).

Esta traducción es parte del resultado del trabajo que el Grupo ISO/TC 262/STTF viene desarrollando

desde su creación en el año 2017 para lograr la unificación de la terminología en lengua española en el

ámbito de la gestión del riesgo.

Traducción oficial/Official translation/Traduction officielle

Introducción

Este documento está dirigido a las personas que crean y protegen el valor en las organizaciones

gestionando riesgos, tomando decisiones, estableciendo y logrando objetivos y mejorando el

desempeño.

Las organizaciones de todos los tipos y tamaños se enfrentan a factores e influencias externas e internas

que hacen incierto si lograrán sus objetivos.

La gestión del riesgo es iterativa y asiste a las organizaciones a establecer su estrategia, lograr sus

objetivos y tomar decisiones informadas.

La gestión del riesgo es parte de la gobernanza y el liderazgo y es fundamental en la manera en que se

gestiona la organización en todos sus niveles. Esto contribuye a la mejora de los sistemas de gestión.

La gestión del riesgo es parte de todas las actividades asociadas con la organización e incluye la

interacción con las partes interesadas.

La gestión del riesgo considera los contextos externo e interno de la organización, incluido el

comportamiento humano y los factores culturales.

La gestión del riesgo está basada en los principios, el marco de referencia y el proceso descritos en este

documento, conforme se ilustra en la Figura 1. Estos componentes podrían existir previamente en toda

o parte de la organización, sin embargo, podría ser necesario adaptarlos o mejorarlos para que la

gestión del riesgo sea eficiente, eficaz y coherente.

Figura 1 — Principios, marco de referencia y proceso

Traducción oficial/Official translation/Traduction officielle

vi © ISO 2018 — Todos los derechos reservados

NORMA INTERNACIONAL

Gestión del riesgo — Directrices

1 Objeto y campo de aplicación

Este documento proporciona directrices para gestionar el riesgo al que se enfrentan las organizaciones.

La aplicación de estas directrices puede adaptarse a cualquier organización y a su contexto.

Este documento proporciona un enfoque común para gestionar cualquier tipo de riesgo y no es

específico de una industria o un sector.

Este documento puede utilizarse a lo largo de la vida de la organización y puede aplicarse a cualquier

actividad, incluyendo la toma de decisiones a todos los niveles.

2 Referencias normativas

El presente documento no contiene ref

...

SLOVENSKI SIST ISO 31000

STANDARD maj 2018

Obvladovanje tveganja – Smernice

Risk management – Guidelines

Management du risque – Lignes directrices

Referenčna oznaka

ICS 03.100.01 SIST ISO 31000:2018 (en,sl)

Nadaljevanje na straneh 2 do 32

© 2018-12. Slovenski inštitut za standardizacijo. Razmnoževanje ali kopiranje celote ali delov tega standarda ni dovoljeno.

SIST ISO 31000 : 2018

NACIONALNI UVOD

Standard SIST ISO 31000 (sl, en), Obvladovanje tveganja – Smernice, 2018, ima status slovenskega

standarda in je enakovreden mednarodnemu standardu ISO 31000, Risk management – Guidelines,

2018.

Ta standard nadomešča SIST ISO 31000:2011.

NACIONALNI PREDGOVOR

Mednarodni standard ISO 31000:2018 je pripravil tehnični odbor ISO/TC 262 Obvladovanje tveganja.

Slovenski standard SIST ISO 31000:2018 je prevod angleškega besedila mednarodnega standarda ISO

31000:2018. V primeru spora glede besedila slovenskega prevoda v tem standardu je odločilen izvirni

mednarodni standard v angleškem jeziku. Slovensko-angleško izdajo standarda je pripravil SIST/TC

VZK Vodenje in zagotavljanje kakovosti.

Odločitev za izdajo tega standarda je dne 26. marca 2018 sprejel SIST/TC VZK Vodenje in

zagotavljanje kakovosti.

ZVEZE S STANDARDI

Ta dokument ne vsebuje zvez s standardi.

OSNOVA ZA IZDAJO STANDARDA

– privzem standarda ISO 31000:2018

PREDHODNA IZDAJA

‒ SIST ISO 31000:2011, Obvladovanje tveganja – Načela in smernice

OPOMBE

– Povsod, kjer se v besedilu standarda uporablja izraz "mednarodni standard", v SIST ISO

31000:2018 to pomeni "slovenski standard".

– Nacionalni uvod in nacionalni predgovor nista sestavni del standarda.

SIST ISO 31000 : 2018

VSEBINA Stran CONTENTS Page

Predgovor . 5 Foreword . 5

Uvod . 7 Introduction . 7

1 Področje uporabe . 9 1 Scope . 9

2 Zveze s standardi . 9 2 Normative references . 9

3 Izrazi in definicije . 9 3 Terms and definitions . 9

4 Načela. 14 4 Principles . 14

5 Okvir . 14 5 Framework . 14

5.1 Splošno . 14 5.1 General . 14

5.2 Voditeljstvo in zavezanost . 16 5.2 Leadership and commitment . 16

5.3 Vključevanje . 17 5.3 Integration . 17

5.4 Zasnova . 17 5.4 Design . 17

5.4.1 Razumevanje organizacije in njenega 5.4.1 Understanding the organization and its

konteksta . 17 context . 17

5.4.2 Izražanje zavezanosti obvladovanju 5.4.2 Articulating risk management

tveganja . 18 commitment . 18

5.4.3 Dodeljevanje organizacijskih vlog, 5.4.3 Assigning organizational roles,

pooblastil in odgovornosti . 19 authorities, responsibilities and

accountabilities . 19

5.4.4 Razporejanje virov . 19 5.4.4 Allocating resources . 19

5.4.5 Vzpostavljanje komuniciranja in 5.4.5 Establishing communication and

posvetovanja . 20 consultation . 20

5.5 Izvajanje . 20 5.5 Implementation . 20

5.6 Ovrednotenje . 21 5.6 Evaluation . 21

5.7 Izboljševanje . 21 5.7 Improvement . 21

5.7.1 Prilagajanje . 21 5.7.1 Adapting . 21

5.7.2 Nenehno izboljševanje . 21 5.7.2 Continually improving . 21

6 Proces. 21 6 Process . 21

6.1 Splošno . 21 6.1 General . 21

6.2 Komuniciranje in posvetovanje . 23 6.2 Communication and consultation . 23

6.3 Obseg, kontekst in merila . 24 6.3 Scope, context and criteria . 24

6.3.1 Splošno . 24 6.3.1 General . 24

6.3.2 Določanje obsega . 24 6.3.2 Defining the scope . 24

6.3.3 Zunanji in notranji kontekst . 24 6.3.3 External and internal context. 24

6.3.4 Določanje meril tveganja . 25 6.3.4 Defining risk criteria . 25

6.4 Ocenjevanje tveganja . 26 6.4 Risk assessment . 26

6.4.1 Splošno . 26 6.4.1 General . 26

6.4.2 Identifikacija tveganja . 26 6.4.2 Risk identification . 26

6.4.3 Analiza tveganja . 27 6.4.3 Risk analysis . 27

6.4.4 Ovrednotenje tveganja . 28 6.4.4 Risk evaluation . 28

6.5 Obravnavanje tveganja . 28 6.5 Risk treatment . 28

SIST ISO 31000 : 2018

6.5.1 Splošno . 28 6.5.1 General . 28

6.5.2 Izbira možnosti obravnavanja 6.5.2 Selection of risk treatment options . 28

tveganja . 28

6.5.3 Priprava in izvajanje načrtov za 6.5.3 Preparing and implementing risk

obravnavanje tveganja . 30 treatment plans . 30

6.6 Spremljanje in pregled . 30 6.6 Monitoring and review . 30

6.7 Zapisovanje in poročanje . 31 6.7 Recording and reporting . 31

Literatura. 32 Bibliography . 32

SIST ISO 31000 : 2018

Predgovor Foreword

ISO (Mednarodna organizacija za ISO (the International Organization for

standardizacijo) je svetovna zveza nacionalnih Standardization) is a worldwide federation of

organov za standarde (članov ISO). Mednarodne national standards bodies (ISO member bodies).

standarde navadno pripravljajo tehnični odbori The work of preparing International Standards is

ISO. Vsak član, ki želi delovati na določenem normally carried out through ISO technical

področju, za katerega je bil ustanovljen tehnični committees. Each member body interested in a

odbor, ima pravico biti zastopan v tem odboru. Pri subject for which a technical committee has been

delu sodelujejo tudi mednarodne vladne in established has the right to be represented on that

nevladne organizacije, povezane z ISO. ISO v committee. International organizations,

vseh zadevah, ki so povezane s standardizacijo governmental and non-governmental, in liaison

na področju elektrotehnike, tesno sodeluje z with ISO, also take part in the work. ISO

Mednarodno elektrotehniško komisijo (IEC). collaborates closely with the International

Electrotechnical Commission (IEC) on all matters

of electrotechnical standardization.

Postopki, uporabljeni pri razvoju tega dokumenta, The procedures used to develop this document

in postopki, predvideni za njegovo nadaljnje and those intended for its further maintenance are

vzdrževanje, so opisani v Direktivah ISO/IEC, 1. described in the ISO/IEC Directives, Part 1. In

del. Posebna pozornost naj se nameni različnim particular the different approval criteria needed for

kriterijem odobritve, potrebnim za različne vrste the different types of ISO documents should be

dokumentov ISO. Ta dokument je bil pripravljen v noted. This document was drafted in accordance

skladu z uredniškimi pravili Direktiv ISO/IEC, 2. del with the editorial rules of the ISO/IEC Directives,

(glej www.iso.org/directives). Part 2 (see www.iso.org/directives).

Opozoriti je treba na možnost, da je lahko nekaj Attention is drawn to the possibility that some of

elementov tega dokumenta predmet patentnih the elements of this document may be the subject

pravic. ISO ne prevzema odgovornosti za of patent rights. ISO shall not be held responsible

identifikacijo katerihkoli ali vseh takih patentnih for identifying any or all such patent rights. Details

pravic. Podrobnosti o morebitnih patentnih of any patent rights identified during the

pravicah, identificiranih med pripravo tega development of the document will be in the

dokumenta, bodo navedene v uvodu in/ali na Introduction and/or on the ISO list of patent

seznamu patentnih izjav, ki jih je prejela declarations received (see www.iso.org/patents).

organizacija ISO (glej www.iso.org/patents).

Morebitna trgovska imena, uporabljena v tem Any trade name used in this document is

dokumentu, so informacije za uporabnike in ne information given for the convenience of users

pomenijo podpore blagovni znamki. and does not constitute an endorsement.

Za razlago prostovoljne narave standardov, For an explanation on the voluntary nature of

pomena specifičnih pojmov in izrazov ISO, standards, the meaning of ISO specific terms and

povezanih z ugotavljanjem skladnosti, ter informacij expressions related to conformity assessment, as

o tem, kako ISO spoštuje načela Mednarodne well as information about ISO’s adherence to the

trgovinske organizacije (WTO) v Tehničnih ovirah World Trade Organization (WTO) principles in the

pri trgovanju (TBT), glej naslednji naslov URL: Technical Barriers to Trade (TBT) see the

www.iso.org/foreword.html. following URL: www.iso.org/iso/foreword.html.

Ta dokument je pripravil tehnični odbor ISO/TC This document was prepared by Technical

262 Obvladovanje tveganja. Committee ISO/TC 262, Risk management.

Ta druga izdaja razveljavlja in nadomešča prvo This second edition cancels and replaces the first

izdajo (ISO 31000:2009), ki je bila tehnično edition (ISO 31000:2009) which has been

revidirana. technically revised.

SIST ISO 31000 : 2018

Glavne spremembe glede na predhodno različico The main changes compared to the previous

so naslednje: edition are as follows:

– review of the principles of risk management,

‒ prenovljena načela obvladovanja tveganja,

which are the key criteria for its success;

ki so ključna merila za njegovo uspešnost,

‒ highlighting of the leadership by top

‒ poudarjanje voditeljstva najvišjega vodstva

management and the integration of risk

in vključevanja obvladovanja tveganja,

management, starting with the governance

začenši z vodenjem organizacije,

of the organization;

– greater emphasis on the iterative nature of

‒ večji poudarek na ponavljajoči se naravi

risk management, noting that new

obvladovanja tveganja, pri čemer lahko nove

experiences, knowledge and analysis can

izkušnje, znanje in analize vodijo do revizije

lead to a revision of process elements,

elementov procesa, ukrepov in ukrepov za

actions and controls at each stage of the

obvladovanje tveganja na posamezni stopnji

process;

procesa,

– streamlining of the content with greater focus

‒ poenostavitev vsebine z večjo osredo-

on sustaining an open systems model to fit

točenostjo na ohranjanju modela odprtega

multiple needs and contexts.

sistema, ki ustreza več potrebam in

kontekstom.

SIST ISO 31000 : 2018

Uvod Introduction

Ta dokument je pripravljen, da ga uporabljajo This document is for use by people who create

osebe, ki z obvladovanjem tveganj, and protect value in organizations by managing

sprejemanjem odločitev, postavljanjem in risks, making decisions, setting and achieving

doseganjem ciljev ter izboljšanjem delovanja objectives and improving performance.

ustvarjajo in varujejo vrednost v organizacijah.

Organizacije vseh vrst in velikosti se soočajo z Organizations of all types and sizes face external

zunanjimi in notranjimi dejavniki ter vplivi, ki jih and internal factors and influences that make it

postavljajo v negotovost, ali bodo dosegle svoje uncertain whether they will achieve their

cilje. objectives.

Obvladovanje tveganja je ponavljajoč se proces Managing risk is iterative and assists

in organizacijam pomaga pri vzpostavljanju organizations in setting strategy, achieving

strategije, doseganju ciljev in sprejemanju objectives and making informed decisions.

informiranih odločitev.

Obvladovanje tveganja je del vodenja in Managing risk is part of governance and

voditeljstva ter predstavlja podlago za vodenje leadership, and is fundamental to how the

organizacije na vseh ravneh. Prispeva k organization is managed at all levels. It

izboljšanju sistemov vodenja. contributes to the improvement of management

systems.

Obvladovanje tveganja je del vseh aktivnosti, Managing risk is part of all activities associated

povezanih z organizacijo, in vključuje interakcijo with an organization and includes interaction

z deležniki. with stakeholders.

Obvla

...

Questions, Comments and Discussion

Ask us and Technical Secretary will try to provide an answer. You can facilitate discussion about the standard in here.